City Limits vs. County Living in Buford, GA | Taxes, Schools & Boundaries Explained

Last Updated October, 6, 2025

The phrase "I live in Buford" means dramatically different things depending on whether you're actually within city limits or simply using Buford as your mailing address from unincorporated county areas. This distinction isn't semantic hairsplitting—it fundamentally affects your property taxes, school access, utility costs, and daily services in ways that can represent thousands of dollars annually and determine whether your children attend Georgia's top-ranked school district or alternative county systems.

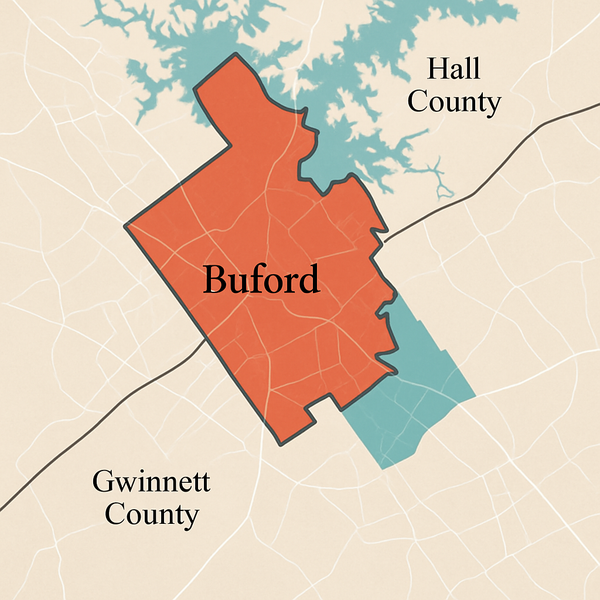

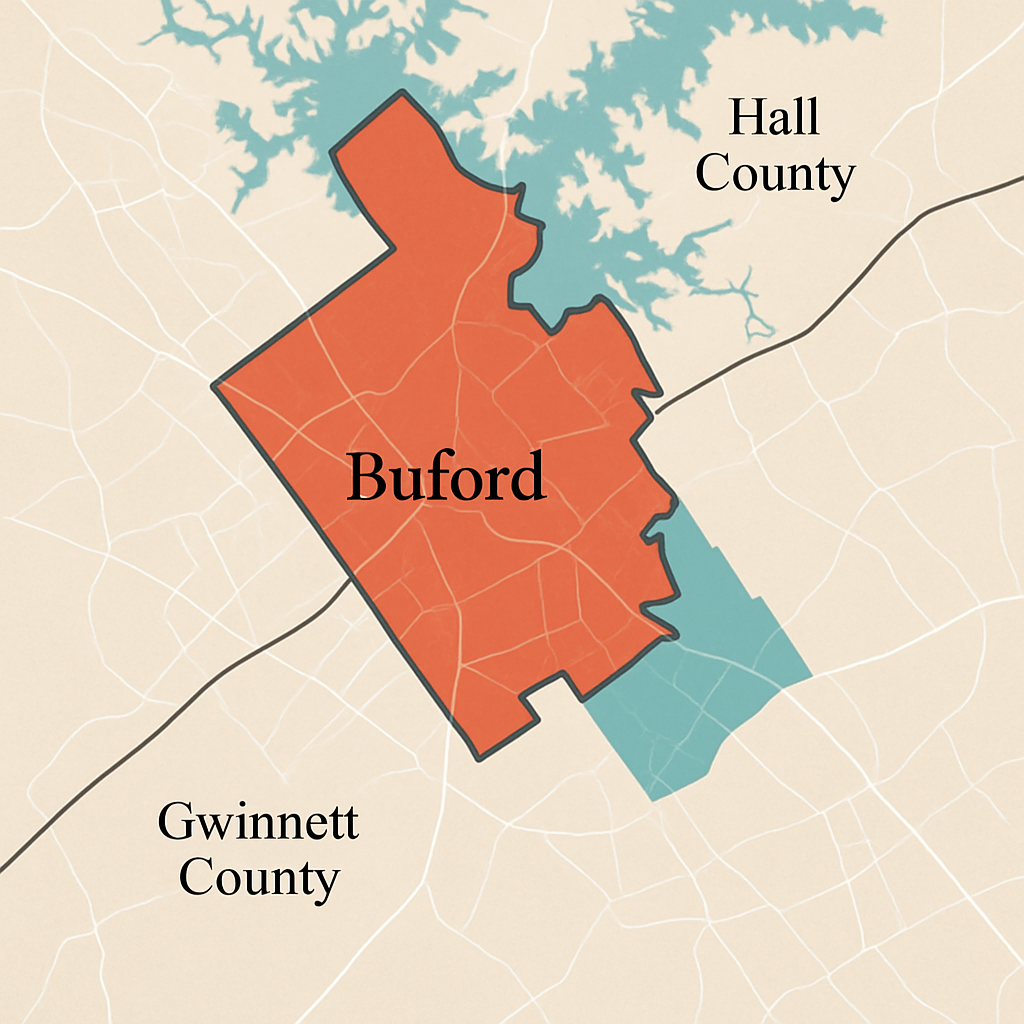

Buford's unique geography spanning both Gwinnett and Hall counties, combined with ZIP codes extending well beyond actual city boundaries, creates confusion that costs uninformed buyers real money and opportunity. Understanding these jurisdictional complexities before purchasing prevents expensive surprises and ensures your property delivers the services and benefits you're actually paying for. For those researching Lake Lanier living or evaluating the cost to live on Lake Lanier, these boundary distinctions represent critical information that marketing materials conveniently gloss over.

Geographic Reality: Where Buford Actually Exists

Buford operates as a unique city spanning both Gwinnett and Hall counties, with the majority located in Gwinnett County and a northern portion extending into Hall County. The city encompasses ZIP codes 30515 (primarily PO boxes), 30518, and 30519—but here's the critical detail that confuses buyers: these ZIP codes extend far beyond actual city limits into unincorporated county areas using Buford as their postal designation.

This means properties throughout a large geographical area carry "Buford" addresses despite falling under county rather than city jurisdiction. The City of Buford itself represents a relatively compact incorporated area, while surrounding unincorporated lands in both counties use Buford for mail delivery without receiving city services or facing city taxes.

The confusion this creates isn't accidental—it's inherent to how postal designations work independently from municipal boundaries. Real estate listings showing "Buford" addresses attract buyers specifically seeking city amenities, particularly access to Buford City Schools, without always clarifying that the address doesn't guarantee those benefits. Buyers must verify actual jurisdictional status rather than trusting addresses, ZIP codes, or even agent representations that may reflect incomplete understanding of boundary complexities. Understanding these pros and cons of living in Buford requires first understanding where Buford actually exists from a legal rather than postal perspective.

Property Tax Structures: Following the Money

Dual Taxation Within City Limits

City of Buford residents face dual tax structures, paying both city and county property taxes that combine for higher total rates than county-only residents experience. For the Gwinnett County portion of Buford, the 2025 total millage rate reaches 14.500 mills, combining the county's 14.35 mills with additional city levies varying by property type. Hall County portions face even higher combined rates at 20.955 mills (2024), reflecting that county's generally higher tax structure plus city and school district components.

These rates translate to effective property tax percentages of approximately 1.08% of assessed value in Buford's Gwinnett portion and 1.09% in the Hall portion—rates that exceed what many buyers expect based on Georgia's reputation for moderate property taxes. A $400,000 home in Buford's Gwinnett portion generates roughly $4,320 in annual property taxes, while the same home in the Hall portion costs approximately $4,360 annually.

County-Only Taxation Advantages

Unincorporated Gwinnett County residents with Buford mailing addresses pay substantially less—approximately 14.71 mills total (2024) without additional city taxes. This represents meaningful savings that compound over years of ownership. That same $400,000 home in unincorporated Gwinnett generates approximately $4,000 in annual property taxes—$320 less than city properties annually, or $3,200 over a decade of ownership.

The Hall County unincorporated tax structure varies but generally reflects that county's higher rates without adding city levies. Understanding Lake Lanier property taxes by county requires recognizing these city-versus-county distinctions that dramatically affect actual tax burdens beyond headline millage rate comparisons.

Tax Exemptions and Benefits

City of Buford residents access exemptions unavailable to county residents, potentially offsetting higher base rates. The city offers a $100,000 homestead exemption reducing assessed value, a Value Offset Exemption freezing assessed values to 2020 base years, and senior exemptions providing complete tax elimination at age 65+. These benefits can dramatically reduce actual tax obligations for qualifying residents, sometimes resulting in lower effective taxes than county properties despite higher nominal rates.

County residents receive county-level exemptions but miss city-specific benefits that make raw millage rate comparisons misleading. The senior exemption particularly matters for those considering retiring on Lake Lanier in Buford—city residents potentially eliminate property taxes entirely after age 65, while county residents continue paying regardless of age.

School District Access: The Deal-Breaker for Many Families

This represents perhaps the most significant difference for families and the primary reason many buyers specifically seek Buford properties. Buford City School District serves only students living within incorporated city limits, operating five schools for approximately 5,000 students with consistent rankings as Georgia's top school district.

Areas with Buford mailing addresses outside city limits fall into either Gwinnett County Public Schools for unincorporated Gwinnett properties or Hall County Schools for unincorporated Hall County locations. Both county systems include quality schools, but neither matches Buford City Schools' concentrated excellence, smaller class sizes, and community-oriented approach that defines the city district's appeal.

The school access distinction drives substantial property value premiums—homes within Buford City School boundaries command $50,000 to $100,000+ premiums over otherwise comparable properties in county systems. This premium reflects genuine value that families willingly pay for demonstrable educational excellence, but only if the property actually provides the access being purchased.

Verification Requirements

Families must verify school attendance zones through respective district boundary tools rather than trusting Buford addresses, ZIP codes, or real estate listing claims. The Buford City Schools attendance boundary map provides definitive information, while Gwinnett County Public Schools and Hall County Schools maintain their own boundary tools for county properties.

This verification must occur before making offers—discovering school access issues after closing creates expensive problems without realistic solutions. Buyers paying Buford premiums for school access that doesn't exist have limited recourse beyond reselling at losses or accepting county schools they specifically sought to avoid.

Utility Services: Following Infrastructure Lines

Municipal Utilities Within City Limits

City of Buford provides comprehensive utility services creating substantial ongoing savings that partially offset higher property taxes. Buford operates Georgia's third-largest municipal gas system, serving over 46,000 customers across five counties with rates significantly lower than competitors like Atlanta Gas Light. Monthly savings of $20-40 compared to private gas providers compound to $240-480 annually—meaningful amounts over decades of ownership.

The city also provides electrical distribution generating approximately $28 million annually, water services, and municipal garbage collection with scheduled pickup throughout city limits. These integrated municipal services create convenience and cost savings that county residents miss despite paying lower property taxes.

County Utility Arrangements

Unincorporated county residents with Buford addresses receive water and sewer through Gwinnett County Water Resources, gas through various private providers (though some areas access Buford Gas if within service territory), electricity through Georgia Power or alternatives, and garbage collection through private companies like Republic Services or Advanced Disposal.

The fragmented service approach requires managing multiple provider relationships and typically costs more than integrated municipal services, though the lower property taxes often exceed utility cost differences. The calculation requires comparing actual utility bills and tax obligations for specific properties rather than assuming one approach universally costs less.

Public Safety: Consistent Across Boundaries

Both city and county residents receive police services through Gwinnett County Police Department's North Precinct and fire/emergency services through Gwinnett County Fire and Emergency Services. This consistency means public safety service levels don't differ based on city versus county status—response times, staffing, and capabilities remain uniform throughout the greater Buford area regardless of jurisdictional boundaries.

The county-wide approach eliminates the service fragmentation that utilities create, ensuring all residents receive equivalent police and fire protection. This uniformity represents one area where jurisdictional boundaries don't create meaningful differences affecting daily life or emergency response.

Real-World Implications: What This Actually Means

For Families Prioritizing Schools

Families where Buford City Schools access represents the primary purchase motivation must verify city limits status before considering properties. Paying premiums for Buford addresses without confirming actual school district boundaries wastes money on benefits you're not receiving. The school premium only makes financial sense when properties actually provide the access justifying higher costs.

Properties just outside city limits sometimes cost $50,000-100,000 less than comparable city properties while offering similar lake access, neighborhood quality, and general amenities—potentially excellent values if you're comfortable with county schools. But if school quality represents your top priority, the savings become false economy that doesn't deliver what you actually need.

For Retirees and Empty Nesters

Retirees without school-age children face different calculations. The lower property taxes in unincorporated areas combined with county utility arrangements might represent better value if you're not utilizing school access justifying city premiums. However, city utility savings—particularly natural gas costs—and senior tax exemptions potentially eliminating property taxes entirely after age 65 create compelling long-term value for city properties.

The optimal choice depends on individual circumstances including energy usage patterns, expected longevity in the home, and whether you'll reach 65+ during your ownership period. Running actual numbers for specific properties rather than making assumptions based on general patterns ensures decisions align with your particular situation. Understanding the overall cost to live on Lake Lanier requires factoring these jurisdiction-specific costs into comprehensive budget calculations.

For Lake Access Priorities

Lake access doesn't correlate perfectly with city boundaries—excellent lake properties exist both within city limits and in surrounding unincorporated areas. Buyers prioritizing water recreation over schools might find better values in county properties offering similar lake access at lower purchase prices and property taxes. The boating lifestyle on Lake Lanier in Buford remains accessible regardless of jurisdictional status, as public boat ramps, marinas, and waterfront dining serve all residents equally.

Similarly, access to Lake Lanier beaches in Buford doesn't depend on city versus county residence—the U.S. Army Corps of Engineers facilities and public parks welcome all visitors regardless of address. When comparing North vs South Lake Lanier locations, recognize that jurisdictional boundaries cut across geographical lake areas in ways that don't align with intuitive north-south distinctions. Properties near each other might fall under different jurisdictions with substantially different tax and service implications.

For Investment and Resale Considerations

City properties within Buford City School boundaries maintain stronger resale markets and value retention than county properties, reflecting ongoing demand from families seeking school access. This demand creates cushion during market downturns and supports appreciation during growth periods—important considerations for buyers viewing properties as financial investments beyond just housing. Current Lake Lanier real estate market trends consistently show school-zoned properties appreciating faster and selling quicker than comparable county homes.

County properties offer lower entry costs and ongoing expenses but face more limited buyer pools excluding school-focused families. The narrower demand creates vulnerability during market corrections and potentially slower sales when listing. These resale considerations affect long-term returns beyond immediate purchase and carrying costs.

Critical Due Diligence: Protecting Your Investment

Definitive Boundary Verification

Use the City of Buford GIS Mapping tool to definitively verify whether properties fall within city limits. This official city resource provides authoritative boundary information that supersedes real estate listing claims, agent representations, or assumptions based on addresses and ZIP codes.

Contact Buford City Hall at 2300 Buford Highway for verification if online tools create any uncertainty. Speaking directly with city staff eliminates ambiguity and provides documentation you can reference if disputes arise regarding jurisdictional status. For properties near boundaries, even small measurement differences determine whether you're paying for city services and school access or not—verification eliminates expensive mistakes.

Check with appropriate county assessor offices to confirm tax jurisdiction and understand how properties are classified for assessment purposes. Sometimes properties sit on boundary lines creating confusion about which jurisdiction applies—definitive determination prevents surprises when first tax bills arrive showing different amounts than anticipated.

Comprehensive Cost Modeling

Request actual utility bills from current owners showing gas, electric, water, and garbage costs over 12-month periods. These real-world costs reveal whether city utility savings offset higher property taxes or if county arrangements actually cost less despite lower tax rates. Seasonal variations in utility costs make annual data essential rather than single-month snapshots that might not reflect typical usage.

Calculate total annual costs including property taxes, all utilities, HOA fees if applicable, insurance, and maintenance reserves. This comprehensive modeling reveals true ownership costs beyond purchase prices and mortgage payments. Properties appearing less expensive based on purchase prices sometimes cost more annually when all factors combine, while seemingly expensive properties might deliver lower total costs through utility savings and tax exemptions.

School Verification Beyond Boundaries

Beyond verifying properties fall within Buford City School District boundaries, confirm specific school assignments for elementary, middle, and high school levels. District boundaries determine eligibility, but school assignments within districts can change based on capacity management and redistricting as growth continues.

Visit assigned schools during operating hours, speaking with administrators and observing facilities to ensure they match expectations. School district reputations represent averages—individual schools within districts vary in quality, programs, and culture. Verify the specific schools your children would attend rather than assuming district-wide reputation guarantees quality at every campus.

Property Inspection Considerations

Thorough Lake Lanier home inspections should address jurisdiction-specific issues including utility service conditions, whether city water/sewer connections exist and function properly, and dock permitting status for waterfront properties. City versus county jurisdiction can affect permitting requirements and inspection standards, making specialized local knowledge essential for comprehensive property assessment.

Long-Term Planning Considerations

Consider how jurisdictional differences affect long-term plans including potential retirement, aging in place scenarios, and eventual resale. City properties offer senior tax exemptions potentially eliminating property taxes entirely after 65, but only if you remain in city limits—moving to county properties later means losing that benefit. County properties cost less initially but lack exemption pathways reducing costs as you age.

Think through scenarios where children age out of schools—does school access justifying city premiums still matter when kids graduate, or do lower county costs become more attractive? Some families intentionally purchase county properties when children are young, then relocate to city boundaries when school attendance begins, maximizing value during each life stage.

Comparing New Construction and Existing Homes Across Boundaries

When evaluating new construction versus existing homes on Lake Lanier, jurisdictional considerations add another layer of complexity. New developments might market "Buford" locations while actually sitting outside city limits, requiring extra verification. Existing homes in established city neighborhoods provide certainty about school access and services, while new construction sometimes creates boundary ambiguity until final platting and annexation decisions complete.

Some developers pursue annexation into city limits to access Buford City Schools for new developments, but this process takes time and isn't guaranteed. Buying in developments where annexation is "planned" or "anticipated" without completed annexation creates risks—you might pay city-level pricing without actually receiving city services or school access if annexation doesn't occur as expected.

Working with Knowledgeable Real Estate Professionals

Navigating these jurisdictional complexities requires working with experienced Lake Lanier real estate professionals intimately familiar with Buford's boundary nuances, school district lines, and how jurisdictional differences affect values and costs. Generic residential agents often miss these critical details, making representations based on incomplete understanding that create problems buyers discover only after closing.

Specialists understand which neighborhoods sit on boundary lines requiring extra verification, how recent annexations have changed city limits affecting school access, and which developments marketed with "Buford" names actually fall outside city boundaries. This knowledge prevents expensive mistakes while identifying opportunities others miss—sometimes the best values come from county properties offering similar amenities at lower costs when school access isn't priority.

The investment in expert guidance pays dividends through avoided problems, appropriate property selection matching your priorities, and negotiations reflecting accurate understanding of how jurisdictional factors affect values. Buford's complexity makes local expertise essential rather than optional for buyers seeking optimal outcomes. Browse our Lake Lanier real estate blog for additional insights about navigating these complex decisions.

Luxury Market Considerations

For those exploring Lake Lanier luxury real estate, jurisdictional boundaries create interesting dynamics. Luxury lakefront properties exist in both city and county jurisdictions, with buyers paying premiums for water access that often dwarf the tax differences between jurisdictions. However, city utility services—particularly natural gas savings—compound over decades of ownership in ways that affect long-term ownership costs even for affluent buyers.

Some luxury buyers specifically seek county properties to avoid city restrictions on property modifications, dock sizes, or development intensity. County zoning sometimes permits larger structures or more extensive improvements than city codes allow, creating value for buyers whose plans exceed city limitations. Understanding these regulatory differences helps luxury buyers make informed choices aligned with their specific property use intentions.

Making Informed Jurisdictional Decisions

The city limits versus county distinction fundamentally shapes your Buford experience—affecting taxes, schools, utilities, and long-term costs in ways that compound over years and decades of ownership. Understanding these differences before purchasing ensures decisions align with priorities rather than creating expensive surprises discovered too late to address practically.

Neither option universally beats the other—the right choice depends on individual priorities, family situations, financial circumstances, and long-term plans. Families prioritizing school access need city properties despite higher costs. Buyers focusing on lake recreation without school concerns might find better values in county locations. Retirees must evaluate whether city utility savings and senior exemptions or county tax advantages deliver superior long-term value based on personal circumstances.

The critical factor isn't which jurisdiction is "better" but rather which aligns with your specific needs and priorities. That requires honest self-assessment, comprehensive cost analysis, definitive boundary verification, and recognition that marketing narratives about "Buford living" often gloss over distinctions that dramatically affect your actual experience and costs.

Make your decision based on verified facts about specific properties rather than assumptions about addresses, ZIP codes, or generic claims about Buford benefits. The few hours invested in thorough verification and cost modeling before purchasing prevents years of dissatisfaction or unexpected expenses discovered only after commitments become irreversible. In Buford's jurisdictionally complex environment, that due diligence represents the difference between successful purchases delivering expected benefits and expensive mistakes requiring costly corrections.

About the Author: Beka Rickman

Beka Rickman is a Lake Lanier Resident and licensed REALTOR® specializing in Buford. (GA License ID 361599) who helps families navigate lakefront living with confidence. She shows properties by boat, tracks dock usability during water-level shifts, and brings insider expertise on Lake Lanier water levels, Corps of Engineers permitting, and community dynamics. With 8+ years of real estate experience and 10+ years living the lake lifestyle, she ensures clients understand not just the home—but the lifestyle that comes with it.

Contact: beka@bekasells.com • (404) 606-3905

Categories

Recent Posts