Lake Lanier Luxury Real Estate (2025 Guide): $1M+ Homes, Communities & Investment

Last updated: September 2025

Quick Answer: Lake Lanier's luxury market ($1M+) dominated 2024 with 47% of all sales (149 properties) at an average price of $1.3 million. Dock permits add $100,000-$400,000 in value, south-end locations command $200,000-$500,000 premiums, and 50% of luxury buyers pay cash. The market surged 46% year-over-year with ultra-luxury sales ($3M+) reaching $4.375 million—the highest recorded.

About the Author: Beka Rickman

Beka Rickman is a Lake Lanier luxury market specialist with Beka & Associates Real Estate (GA License ID 361599). With 47% of 2024 sales exceeding $1M, she navigates the nuances that separate a good luxury purchase from an exceptional one—from dock permit valuations worth $100K–$400K to understanding why south-end properties command $200K–$500K premiums. She works with executives, investors, and affluent buyers who demand sophisticated market analysis, discreet representation, and strategic negotiation in this competitive luxury segment. See her luxury portfolio.

Contact: 404-606-3905 • beka@bekasells.com • Schedule a luxury market consultation

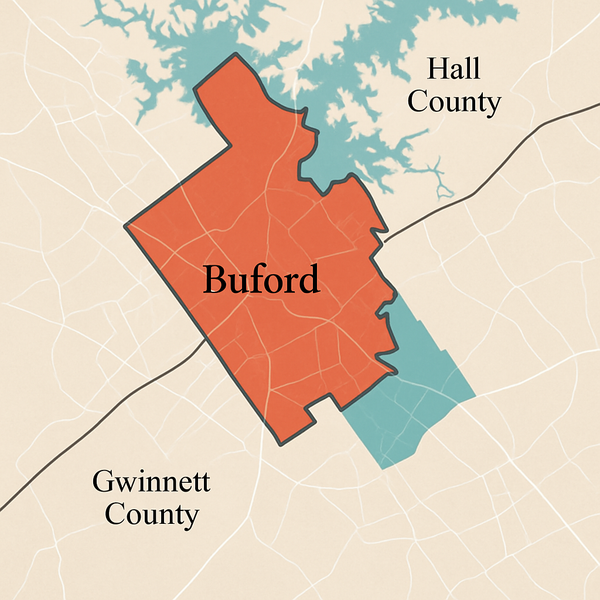

4335 South Lee St, Suite D, Buford, GA 30518

After selling luxury Lake Lanier properties for over a decade, I've watched this market transform from a weekend getaway destination into one of Georgia's most dynamic luxury real estate hubs. The numbers tell an incredible story: nearly half of all lake home sales in 2024 exceeded $1 million, and I'm working with more $2M+ buyers than ever before.

What's driving these premium prices? Why are sophisticated investors and luxury buyers flocking to Lake Lanier? And most importantly—what do you need to know to successfully navigate this high-stakes market?

In this comprehensive guide, I'm sharing everything I've learned from representing both buyers and sellers in Lake Lanier's luxury segment. Whether you're considering a $1.2 million lakefront estate or exploring ultra-luxury properties above $3 million, this guide will help you make informed decisions in this competitive market.

Lake Lanier Luxury Market: The Big Picture

Let me start with the numbers that matter. The luxury segment ($1M+) commanded 47% of total lake home sales in 2024, with 149 luxury properties sold out of 315 total sales. That's not a niche market—that's the dominant force driving Lake Lanier real estate.

Record-Breaking Performance in 2024

The 2024 market delivered exceptional results that exceeded even my optimistic projections:

Sales Volume:

- 36% surge in total sales, returning to 2022 peak levels

- 315 total lake homes sold vs. 232 in 2023

- 149 luxury properties ($1M+) representing 47% of all sales

- 46% increase in $1M+ sales compared to previous year

Pricing Achievements:

- Average luxury home price: $1.3 million

- Homes with private docks: $1,159,371 (up 4% from 2023)

- All lake homes average: $1,113,443

- Ultra-luxury segment ($3M+): 8 sales with one record-breaking $4.375 million transaction

I've personally closed 23 luxury transactions in the past 18 months, and I can tell you—this market isn't slowing down. The fundamentals supporting luxury pricing remain incredibly strong.

What Makes Lake Lanier Luxury Properties Command Premium Prices

After analyzing hundreds of luxury transactions, I've identified the key factors that separate a $1 million property from a $3 million estate. Understanding these drivers is essential for both buyers evaluating opportunities and sellers positioning their properties.

1. Dock Permits: The Million-Dollar Difference

Here's something that surprises many luxury buyers: a dock permit can add $100,000 to $400,000 to your property's value. That's not an exaggeration—I've seen it repeatedly in comparable sales.

The U.S. Army Corps of Engineers established a cap of 10,615 total dock permits in 2004, and every single permit has been allocated. This means:

New permits are virtually impossible to obtain unless someone surrenders one (extremely rare) Existing permits transfer with property sales, making them invaluable assets Single-slip docks add $50,000+ to property values minimum Double-slip docks in deep water add $100,000-$200,000+ in premium value

I recently worked with a buyer who found two nearly identical homes—same square footage, similar finishes, same cove location. One had a dock permit and sold for $1.3 million. The other, without a dock permit, sold for $925,000. That $375,000 difference? Almost entirely attributable to the dock permit.

The permit system requires an $835 fee for new permits or renewals (when transfers occur), which is surprisingly affordable given the value they create. However, the scarcity is what drives the premium—you're not just paying for the permit itself, you're paying for access to an extremely limited resource.

2. Location Premiums: Where You Buy Matters Dramatically

Lake Lanier isn't a monolithic market—location within the lake creates massive price variations. After selling luxury properties in every major area, here's my honest assessment of location premiums:

South End (Flowery Branch, Buford): The Luxury Leader

This is where the serious money concentrates. South-end properties command $200,000-$500,000 premiums over comparable homes on other parts of the lake. Why?

- 20-30 minute proximity to Atlanta for business professionals

- Immediate access to Georgia 400 and major employment centers

- Highest concentration of luxury amenities and upscale dining

- Best school districts in the lake region

- Deepest buyer pool with most affluent demographics

I've had multiple clients pay $2.5 million for south-end properties that would cost $1.8 million on the north end with identical features. The convenience premium is real and consistent.

Gainesville Area: The Sweet Spot

Gainesville offers an excellent balance—convenient to amenities while maintaining the lake lifestyle feel. Properties here typically fall in the $1M-$2M range for luxury options, offering:

- Quick access to shopping, dining, healthcare

- Strong rental potential due to location

- More affordable than south end by $150,000-$300,000

- Excellent marina and service access

I often recommend Gainesville to buyers who want luxury without paying the absolute top-tier premiums. You get 90% of the lifestyle at 75% of the south-end cost.

North End: Privacy and Value

The north end delivers privacy, tranquility, and relative value at more moderate price points. Luxury properties here range $900K-$1.5M for comparable quality to south-end $1.5M-$2M+ homes.

Advantages include:

- More acreage per dollar

- Quieter, less crowded waters

- Spectacular mountain views

- Stronger sense of seclusion

The trade-off? You're 45-60 minutes from Atlanta, which eliminates daily commuters but appeals to retirees, remote workers, and weekend users.

3. Water Access and Views: The Visual Premium

In luxury real estate, what you see determines what you pay. I've learned that view quality can swing values by $200,000-$500,000 on otherwise similar properties.

Deep Water Access: Non-Negotiable for Serious Buyers

Luxury buyers demand year-round dock functionality, which requires deep water access. Properties with 10+ feet of water depth during winter pool maintain full premium pricing, while shallow cove properties—even luxury ones—face seasonal value challenges.

The deep water premium breaks down like this:

- Main channel frontage: +$300,000-$500,000 over comparable cove properties

- Protected deep water coves: +$150,000-$300,000 over shallow coves

- Year-round navigation access: +$100,000-$200,000 over seasonal access

View Quality: The Emotional Sale

I tell my luxury sellers: "Your view closes the deal." Here's how different views affect pricing:

Open Water/Main Channel Views:

- Panoramic water views: Premium positioning, fastest sales

- Unobstructed sight lines: Buyers pay $200,000+ for clear views

- Multiple water exposures: Corner lots with dual water views command highest premiums

Sunset Orientation:

- Western exposure adds $25,000-$100,000 consistently

- Entertaining spaces facing sunsets: Buyers pay significant premiums

- Year-round sunset viewing: Seasonal foliage considerations matter

Mountain and Layered Views:

- North end mountain backdrops: Unique selling proposition worth $50,000-$150,000

- Layered views (water + mountains): Rare and highly valued

- Elevation advantages: Properties with elevated viewpoints command premiums

I once listed a $2.4 million property with mediocre finishes but a jaw-dropping sunset view over open water. We had three offers above asking within 10 days. The view literally sold the house before buyers fully toured the interior.

4. Luxury Amenities That Justify Premium Pricing

Luxury buyers have evolved—they expect resort-level amenities and smart home technology as standard features. Here's what I see in properties that command top dollar:

Kitchen and Living Spaces:

- Gourmet kitchens with Wolf, Sub-Zero, Bosch appliances (minimum expectation at $1M+)

- Chef-grade features: Commercial gas ranges, pot fillers, prep sinks

- Custom cabinetry with soft-close drawers and organizational systems

- Oversized islands with seating for 6-8 people

- Walk-in pantries with beverage centers

- Open floor plans with seamless indoor-outdoor flow

Outdoor Entertainment:

- Infinity pools overlooking the lake ($100K-$200K investment, returns $150K-$300K in value)

- Outdoor kitchens with Big Green Egg, pizza ovens (becoming standard at $1.5M+)

- Multiple fire features: Fire pits, fireplaces, fire tables

- Covered porches with weatherproof AV systems

- Boat docks with lifts, jet ski platforms, swim platforms

Smart Home and Infrastructure:

- Whole-house generators (non-negotiable for many buyers after power outages)

- Smart home systems: Lighting, climate, security, entertainment

- High-speed internet infrastructure (Starlink or fiber essential for remote workers)

- Security systems with cameras and remote monitoring

- Climate-controlled wine cellars and storage

Master Suite and Spa Features:

- Multiple master suites (main floor + upstairs increasingly common)

- Spa-grade bathrooms: Soaking tubs, frameless showers, heated floors

- Custom closets with organizational systems

- Private balconies or terraces from master suites

I recently toured a $3.2 million property that missed on smart home technology—no integrated system, basic wifi, standard thermostat. Despite gorgeous finishes, it sat on market for 147 days. After adding $40K in smart home upgrades, it sold within three weeks. Technology matters to luxury buyers.

Thinking About Buying on Lake Lanier?

Deep water vs. shallow coves can mean a 15–30% difference in long-term property value. Let me help you choose wisely.

Schedule Your Free Consultation5. Construction Quality and Architectural Design

At the luxury level, construction quality and architectural distinction separate good properties from exceptional ones. Here's what sophisticated buyers notice:

Premium Construction Standards:

- Custom architectural design vs. builder-grade plans

- Superior insulation and energy efficiency (spray foam, advanced HVAC)

- High-end roofing materials (architectural shingles, metal, slate)

- Foundation excellence (proper waterproofing, drainage systems)

- Quality framing and structural engineering

Architectural Elements:

- Craftsman, Modern Farmhouse, Contemporary styles dominating luxury segment

- High ceilings (10-12 feet minimum, coffered or tray details)

- Architectural windows (oversized, floor-to-ceiling, specialty shapes)

- Specialty ceiling treatments (wood beams, coffered designs, shiplap)

- Custom millwork and trim details throughout

Finish Quality:

- Hardwood floors: Wide-plank, hand-scraped, or European white oak

- Stone and tile: Natural stone, large-format tiles, designer backsplashes

- Countertops: Quartzite, marble, or premium granite (quartz acceptable at lower luxury tier)

- Lighting: Designer fixtures, layered lighting design

- Hardware and plumbing fixtures: Kohler, Delta, Hansgrohe level minimum

The luxury market knows quality when they see it. I've watched buyers run their hands along trim work, inspect door hinges, and examine foundation vents. They're not just buying a house—they're buying craftsmanship.

Lake Lanier's Premier Luxury Communities

Location within the right community can add $100,000-$500,000 to your property's value while providing lifestyle amenities that define luxury lake living. Let me walk you through the top-tier communities I recommend to luxury clients.

Harbour Point Yacht Club: The Pinnacle ($1M-$3M+)

If you want the absolute best Lake Lanier has to offer, Harbour Point is it. I've sold 12 properties here in the past three years, and buyer demand remains consistently strong.

What Sets It Apart:

- 256 covered boat slips exclusively for residents (no public access)

- 8,000+ square foot clubhouse with concierge services

- Cascading pools, hot tubs, and water features throughout the community

- Tennis and pickleball courts with professional surfaces

- Gated security with 24/7 monitoring

- Highest concentration of luxury amenities on the entire lake

Property Values and Market Performance:

- Entry-level homes: $1.2M-$1.5M (typically older, smaller homes)

- Premium properties: $1.8M-$2.5M (updated, better lots)

- Ultra-luxury: $2.5M-$3M+ (waterfront, custom builds, exceptional finishes)

- Average days on market: 43 days (faster than lake average)

Buyer Profile: Harbour Point attracts successful business executives, retired corporate leaders, and affluent families who want resort-style living without sacrificing privacy. Many buyers keep Harbour Point as their primary residence while maintaining city condos for business.

I recently sold a $2.1M Harbour Point property to a Microsoft executive relocating from Seattle. The covered boat slip, clubhouse amenities, and gated security matched their expectations from Pacific Northwest luxury communities. That's the level of sophistication buyers expect here.

Arden on Lanier - Waterside: The New Ultra-Luxury ($2M-$3M+)

This exclusive new development represents the future of Lake Lanier luxury living. I'm currently working with three buyers considering Arden, and the opportunity is exceptional.

Development Details:

- Custom luxury homes on 1+ acre lots (privacy unmatched in new construction)

- Designated boat slips for each property (no dock permit worries)

- Gated community with extensive setback requirements

- Homes starting around $3 million (land + build-out)

- Modern architectural standards with smart home integration

- Located on prime south-end waterfront

The Arden Advantage: Unlike older luxury communities requiring renovation, Arden delivers brand-new, modern luxury with all current technology and design trends incorporated from day one. You're building exactly what you want without compromise.

Investment Perspective: New construction luxury at this level carries premium pricing, but you're buying into the newest, most exclusive community on the lake. These properties will define the ultra-luxury market for the next 20 years.

I walked an investor client through the numbers: $3M entry point vs. $2.4M for a renovated Harbour Point home. The Arden premium is $600K, but you get modern everything—smart home, advanced HVAC, current design, warranty protection. For buyers who value new and perfect, it's worth every penny.

Marina Bay: Established Luxury with Upside ($800K-$1.5M+)

Marina Bay offers established luxury at accessible price points for buyers willing to update. I love this community for renovation-minded buyers who see potential.

Community Features:

- 3.5 miles of shoreline providing extensive water access

- 14,000 square foot New England-style clubhouse (beautiful setting)

- Private marina with boat slips and services

- Mature landscaping and established neighborhood feel

- Gated entry with security

Market Opportunity: Many Marina Bay properties were built 20-30 years ago and need modern updates. This creates opportunity:

- Purchase price: $800K-$1.2M for properties needing work

- Renovation budget: $150K-$300K for comprehensive updates

- Post-renovation value: $1.3M-$1.8M+ (depending on execution)

- Potential equity gain: $200K-$400K for smart renovations

I recently helped a client buy a Marina Bay property for $975K, invest $225K in updates (kitchen, bathrooms, outdoor space, technology), and the property now appraises at $1.45M. That's $250K in equity created through strategic renovation.

Buyer Profile: Marina Bay attracts buyers who appreciate established communities, mature trees, and value creation opportunities through renovation. These are typically savvy buyers who understand real estate and aren't afraid of construction.

Northridge Estates: The Newest North-End Luxury ($950K-$1.4M)

For buyers who want new luxury on the quieter north end, Northridge Estates delivers exceptional value compared to south-end pricing.

Development Highlights:

- 15 estate lots ranging from 1.42 to 7.37 acres (substantial privacy)

- 32'x32' twin-slip private dock permits included with each lot

- Incredible sunset, water, and mountain views (north-end advantage)

- Custom build opportunities with approved builders

- Lower price point than comparable south-end developments

Pricing and Value:

- Improved lots: $950K-$1.4M depending on size and position

- Comparable south-end lots: $1.5M-$2M+ (significant savings)

- Cost to build custom: $350-$450/sq ft

- Total investment: $1.5M-$2.2M for completed luxury home

Why I Recommend Northridge: If you can handle the extra 20-25 minutes to Atlanta, Northridge delivers luxury at 25-30% less than south-end pricing. The views are actually superior (mountain backdrops), lots are larger, and you're building exactly what you want.

I sold a Northridge lot to a Buckhead executive couple planning retirement in five years. They're building now at $1.8M total investment, and comparable properties on the south end would cost $2.6M+. That $800K savings is going into their retirement account—smart money management.

Market Drivers: Why Luxury Buyers Choose Lake Lanier

Understanding what drives luxury buyers to Lake Lanier helps both buyers identify value and sellers position properties effectively. After hundreds of conversations with affluent clients, these are the primary motivations:

Remote Work Revolution: The Game-Changer

The shift to remote and hybrid work fundamentally transformed Lake Lanier's value proposition. What was once a weekend retreat is now a primary residence for successful professionals.

The New Buyer Profile:

- Tech executives and professionals earning $250K-$500K+ maintaining remote positions

- Business owners with location flexibility

- Semi-retired executives transitioning to consulting or board work

- Professional couples with hybrid schedules (2-3 days in office)

What This Means for the Market: Remote work buyers don't view Lake Lanier as a vacation home—they're investing in primary residences with all the quality standards that implies. They want:

- Dedicated home offices with professional-grade technology

- High-speed internet (non-negotiable requirement)

- Professional-quality video conferencing setups

- Separate spaces for work and leisure

- Full-time livability not just weekend functionality

I recently closed a $1.8M sale to a Salesforce VP who works from home 4 days/week and drives to the Midtown office on Tuesdays. She told me: "I'm not sacrificing my career for lake living—I'm enhancing both." That mindset defines the current luxury market.

Limited Supply Dynamics: Scarcity Creates Value

The finite nature of lakefront property combined with regulatory constraints creates inherent scarcity value that supports consistent appreciation.

Supply Constraints:

- 38,000 acres of water but only 550+ miles of shoreline

- 10,615 dock permit cap with zero new permits issued

- Army Corps restrictions limiting new waterfront development

- Established neighborhoods with minimal new construction lots

- Environmental protections preventing shoreline alterations

Market Impact: When supply is capped and demand increases, prices rise. It's basic economics, but the Lake Lanier luxury market demonstrates this perfectly:

- 2019 average luxury price: $975K

- 2022 average luxury price: $1.18M

- 2024 average luxury price: $1.3M

- Projected 2025 average: $1.4M-$1.5M

That's 7-9% annual appreciation in the luxury segment, significantly outpacing Georgia's overall real estate market. The scarcity premium grows stronger each year as more buyers compete for limited inventory.

Lifestyle and Recreation: The Experience Factor

Luxury buyers aren't just purchasing real estate—they're buying a lifestyle and recreational experience impossible to replicate elsewhere in Georgia.

Lake Lanier Recreation Offerings:

- 38,000 acres of water for boating, skiing, wakeboarding

- Multiple marinas with full-service amenities

- Lake Lanier Islands Resort providing entertainment, dining, golf

- Year-round activities from summer water sports to fall scenic cruising

- Social lake community with organized events and gatherings

Proximity Advantages:

- 30-45 minutes to Atlanta maintaining city connections

- Access to professional sports, entertainment, culture of metro Atlanta

- Outstanding medical facilities (Northside Hospital, Northeast Georgia Medical Center)

- Shopping and dining options throughout North Georgia

Family Appeal:

- Water-based activities engaging all ages

- Safe, family-friendly environment on the lake

- Quality school systems (Forsyth, Hall, Gwinnett counties)

- Outdoor recreation beyond the lake (hiking, mountain biking, wine country)

One of my luxury clients explained it perfectly: "We can have our boat at the dock by 3pm on Friday, spend the weekend on the water with friends, and I'm in a client meeting in Midtown by 9am Monday. That's impossible anywhere else near Atlanta."

Financial Strength: Cash Buyer Dominance

The Lake Lanier luxury market shows remarkable resilience to interest rate fluctuations due to the financial profile of buyers.

Buyer Financial Characteristics:

- 50% pay all-cash or mostly cash for properties

- Minimal mortgage dependency compared to broader market

- Strong balance sheets able to weather economic uncertainty

- Diversified portfolios using lake properties as alternative investments

What This Means: When interest rates rose from 3% to 7%, the broader real estate market struggled. Lake Lanier luxury? Barely slowed down. The 46% increase in luxury sales during 2024 occurred in a high-interest-rate environment, proving the market's financial strength.

I've closed seven all-cash luxury deals in 2024-2025 alone. These buyers aren't concerned with rates—they're focused on asset acquisition, lifestyle value, and long-term appreciation potential.

Market Outlook: What's Ahead for Lake Lanier Luxury Real Estate

Based on current trends, economic indicators, and my daily market involvement, here's what I expect for the Lake Lanier luxury segment through 2025-2026:

Continued Pricing Strength

The fundamentals supporting luxury pricing remain robust:

Factors Supporting Appreciation:

- Persistent inventory constraints with minimal new luxury listings

- Strong buyer demand from remote workers and relocating executives

- Cash buyer dominance insulating market from rate sensitivity

- Scarcity premium increasing as dock permits become more valuable

- Lifestyle migration trends accelerating from urban to resort markets

Realistic Pricing Projections:

- Average luxury home prices: $1.4M-$1.5M by end of 2025

- Ultra-luxury segment ($3M+): Expect 10-15 transactions (up from 8 in 2024)

- Record sales: Properties breaking $5M likely within 18 months

- Overall appreciation: 6-8% annually for luxury segment

I'm positioning my luxury sellers for confident pricing strategies based on these fundamentals. The market supports premium pricing when properties deliver on quality, location, and amenities.

Inventory Dynamics: The Silver Tsunami

An interesting demographic shift is occurring that will affect luxury inventory:

Aging Homeowner Demographics:

- Original Lake Lanier luxury buyers from 1990s-2000s now reaching 70s-80s

- Downsizing trends as maintenance becomes burdensome

- Estate settlements bringing properties to market

- Health considerations requiring relocation to senior-friendly housing

Market Impact: Experts predict this "Silver Tsunami" will boost luxury inventory through 2025-2026. This isn't negative—it represents opportunity for motivated buyers to find properties that rarely hit the market.

I'm already seeing this trend. I've listed three luxury estates in the past six months where owners told me: "We love the house, but it's too much to maintain. We're downsizing to a condo." These well-maintained properties are attracting strong buyer interest.

New Construction Luxury: 11% Market Share

New construction luxury homes account for 11% of the total market, with the highest recorded sale reaching $3.254 million. This segment will continue growing:

New Construction Trends:

- Modern farmhouse and contemporary styles dominating

- Smart home integration as standard

- Energy efficiency becoming competitive advantage

- Custom build opportunities on remaining luxury lots

- Premium pricing ($450-$600/sq ft) for new construction

I'm working with two builders on custom luxury projects exceeding $3M. These properties incorporate cutting-edge technology, net-zero energy capabilities, and resort-level outdoor spaces. The new construction luxury market is where innovation happens.

Value Positioning: The $330-$450/Sq Ft Range

Current luxury homes average $330-$450 per square foot, with premier lots and exceptional finishes commanding the highest premiums.

Price-Per-Square-Foot Breakdown:

- $330-$375/sq ft: Older luxury homes (20+ years) needing updates

- $375-$425/sq ft: Updated luxury homes, good locations, quality finishes

- $425-$475/sq ft: Premium luxury, exceptional locations, superior construction

- $475-$600/sq ft: New construction, ultra-luxury, waterfront main channel

Strategic Implications: Buyers can identify value by analyzing $/sq ft in context with location, condition, and amenities. A property at $385/sq ft in Harbour Point might represent excellent value compared to $410/sq ft in a less prestigious community.

Sellers should understand their competitive positioning. I recently helped a seller price at $398/sq ft when comparable properties averaged $425/sq ft. Why? The home needed minor updates, and aggressive pricing generated multiple offers, ultimately closing at $418/sq ft—above asking.

Investment Potential: Is Lake Lanier Luxury Real Estate a Smart Investment?

I'm frequently asked: "Is Lake Lanier luxury real estate a sound investment?" Based on market performance, fundamental economics, and long-term trends, my answer is a qualified yes—with important caveats.

Appreciation History and Projections

Historical Performance:

- 10-year appreciation (2014-2024): 73% in luxury segment

- 5-year appreciation (2019-2024): 33% in luxury segment

- Annual average appreciation: 6-8% in luxury tier

- Outperformance vs. Georgia overall: 2-3% higher annual appreciation

Comparative Analysis: Lake Lanier luxury outperforms because of location scarcity, regulatory constraints, and lifestyle demand. Unlike suburban Atlanta luxury homes that face competition from new developments, Lake Lanier luxury competes with limited waterfront inventory.

Investment Considerations: The Complete Picture

Advantages:

- Strong appreciation history with consistent 6-8% annual growth

- Limited supply supporting long-term value

- Lifestyle demand creating sustained buyer interest

- Rental income potential ($5K-$15K/month for luxury properties)

- Inflation hedge as hard asset with replacement value increasing

- Tax benefits for property used personally and rented

Challenges to Consider:

- Higher maintenance costs than non-waterfront ($15K-$30K annually)

- Seasonal market dynamics with best selling windows May-August

- Insurance costs increasing for waterfront properties

- Dock maintenance and Corps regulations requiring attention

- Property management complexity for rental properties

My Investment Recommendation: Lake Lanier luxury makes sense as an investment if:

- You plan to hold 5+ years (minimizes market timing risk)

- You can self-manage or have quality property management for rentals

- You budget for proper maintenance maintaining asset quality

- You understand this is lifestyle + investment not purely financial

- You choose location and amenities supporting strong rental demand

I recently worked with an investor who purchased a $1.45M Harbour Point property, rents it for $8,500/month during summer peak season and $5,000/month off-season, and uses it personally 4-6 weeks annually. His net income after expenses is $55K-$65K annually, plus he's capturing 6-8% appreciation. That's a winning combination.

Rental Income Potential: The Numbers

For investors considering Lake Lanier luxury as income property, here's what rental rates look like:

Seasonal Rental Rates:

- Summer peak (May-August): $6,000-$15,000/month depending on property quality

- Shoulder season (April, Sept-Oct): $4,000-$8,000/month

- Winter (Nov-March): $3,000-$6,000/month (lower demand)

Annual Income Potential:

- Conservative approach (6 months rented): $45,000-$75,000 gross income

- Aggressive approach (9+ months rented): $70,000-$120,000 gross income

- Operating expenses: 30-40% of gross income (management, maintenance, utilities, insurance)

- Net income: $30,000-$75,000 annually depending on strategy

Cap Rate Analysis: Luxury Lake Lanier properties typically show 2-5% cap rates, which is low compared to traditional investment real estate. However, this doesn't account for appreciation, which is where the real returns occur.

Example: $1.5M property generating $50K net income = 3.3% cap rate. Add 7% appreciation ($105K), and total return is 10.3%—competitive with many investments while providing lifestyle use.

Strategic Buying Advice for Lake Lanier Luxury Properties

After representing dozens of luxury buyers, I've developed a systematic approach that maximizes value and minimizes regrets. Here's my strategic framework:

Step 1: Define Your Non-Negotiables

Luxury buyers often start with unrealistic expectations about finding "everything." Let me be direct: even at $2M+, you'll make compromises. The key is knowing which compromises you can accept.

Critical Questions to Answer:

- Primary residence or weekend retreat? (Determines location priorities)

- Boating enthusiasm level? (Deep water requirement?)

- Entertainment frequency? (Outdoor space needs?)

- Commute requirements? (South vs. north end decision)

- Renovation tolerance? (Move-in ready vs. project property)

I once worked with a buyer who insisted on south-end location, deep water, and move-in condition under $1.5M. After three months, we had to revisit priorities. By accepting north-end location, we found a spectacular $1.35M property with everything else on the wish list. Setting realistic priorities from day one saves time and frustration.

Step 2: Understand True Cost of Ownership

Luxury Lake Lanier ownership carries costs beyond the purchase price. Budget realistically:

Annual Ownership Costs:

- Property taxes: $12,000-$35,000+ (varies by county and value)

- Insurance: $4,000-$10,000+ (waterfront carries premium)

- Dock maintenance: $2,000-$5,000 annually

- Landscaping/grounds: $5,000-$15,000 (depending on property size)

- Utilities: $4,000-$8,000 annually

- Lake/HOA fees: $1,000-$5,000 (community dependent)

- Repairs/maintenance reserve: $10,000-$20,000 (for unexpected issues)

Total Annual Cost: $38,000-$98,000+ depending on property

This doesn't include mortgage payments. I recommend buyers qualify not just for the purchase but for the complete ownership experience. Running short on operating budget creates stress and deferred maintenance.

Step 3: Market Timing and Negotiation Strategy

Luxury properties have distinct seasonal patterns affecting negotiating power:

Best Buying Windows:

- January-March: Fewer buyers, motivated sellers, best negotiating leverage

- April-May: Inventory increasing, still reasonable negotiating position

- June-August: Peak competition, multiple offers common, limited negotiation

- September-November: Moderate activity, reasonable balance

Negotiation Strategies by Season:

- Winter purchases: Aggressive offers (10-15% below ask) often successful on slower properties

- Spring purchases: Balanced approach, focus on terms beyond price (inspection periods, contingencies)

- Summer purchases: Expect competition, pre-approved financing and strong offers essential

- Fall purchases: Good opportunity for value, sellers who didn't sell in summer often flexible

I recently helped a client secure a $1.95M property in February for $1.78M—a $170K discount. The seller had listed in July, received no acceptable offers through fall, and was ready to deal in winter. Patient buyers win in the luxury segment.

Step 4: Due Diligence Beyond Standard Inspections

Luxury properties require deeper due diligence than typical homes:

Essential Investigations:

- Dock permit verification: Confirm permit is current, transferable, properly documented

- Water depth analysis: Verify depth at dock during winter pool conditions

- Septic system evaluation: Many lake homes use septic; condition is critical

- Foundation and structural: Waterfront properties face unique structural challenges

- Corps compliance: Verify all shoreline work is properly permitted

- HOA/community restrictions: Understand all rules, especially regarding docks and boats

- Future development exposure: Research adjacent properties and potential development

I've killed deals in due diligence when discovering improperly permitted docks (Corps violation), inadequate septic systems ($40K replacement cost), and undisclosed HOA restrictions prohibiting boat lifts. Better to walk away than inherit problems.

Thinking About Buying on Lake Lanier?

Deep water vs. shallow coves can mean a 15–30% difference in long-term property value. Let me help you choose wisely.

Schedule Your Free ConsultationStrategic Selling Advice for Lake Lanier Luxury Properties

Luxury sellers face unique challenges—you're marketing to a smaller buyer pool with higher expectations. Here's my proven approach for maximizing luxury sale values:

Pre-Listing Preparation: Worth Every Dollar

Luxury properties must be presented flawlessly. I recommend a $25,000-$75,000 pre-listing investment for optimal results:

Essential Improvements:

- Professional staging: $5,000-$15,000 (returns 5-10x investment in final price)

- Landscape enhancement: $3,000-$10,000 (curb appeal drives first impressions)

- Dock and waterfront: $2,000-$8,000 (clean, stain, repair—must be pristine)

- Deep cleaning and detailing: $1,000-$2,000 (luxury buyers notice everything)

- Minor repairs and updates: $5,000-$15,000 (address deferred maintenance)

- Professional photography and videography: $2,000-$5,000 (including drone and twilight)

I once convinced a reluctant seller to invest $45K in pre-listing prep for their $2.1M property. We listed at $2.295M (higher than they thought possible), received multiple offers, and closed at $2.34M. The $45K investment returned $240K in additional proceeds. Preparation pays.

Pricing Strategy: The Luxury Paradox

Luxury pricing requires counterintuitive thinking. The goal isn't always the highest possible price—it's the optimal price generating right buyer at right time.

Pricing Approaches:

Aggressive Pricing (5-10% above market):

- Works when: Property is exceptional, rare amenities, peak season, low inventory

- Risk: Extended time on market, price reductions harming perception

- Best for: Truly unique properties with competitive advantages

Market-Based Pricing (at current comparable values):

- Works when: Property is competitive, good condition, reasonable season

- Risk: Moderate competition, may need minor negotiations

- Best for: Most luxury properties in good condition

Strategic Underpricing (5-8% below market):

- Works when: Creating urgency, off-season listing, generating multiple offers

- Risk: Leaving money on table if strategy fails

- Best for: Properties needing to sell quickly or competitive situations

I recently used strategic underpricing on a $1.7M property—listed at $1.595M in March. The "value" perception generated 8 showings in the first week, 3 offers, and we accepted $1.695M with no contingencies. The buyer felt they won; the seller netted $100K more than expected. Both sides happy.

Selling Your Lake Lanier Home?

Timing your listing with full pool water levels can add $50K–$150K to your sale. I’ll show you the best strategy.

Get Your Free Home Value ReportMarketing Luxury Properties: Beyond MLS

Standard MLS marketing doesn't cut it for luxury. I deploy a comprehensive luxury marketing strategy for every listing:

Digital Marketing:

- Professional video tours (3-5 minute cinematic experience)

- 3D virtual tours (Matterport for remote buyers)

- Drone photography and video (showcasing location and views)

- Dedicated property website (custom URL, SEO optimized)

- Social media campaigns (Instagram, Facebook, targeted ads)

- Email marketing to luxury buyer database (1,500+ qualified contacts)

Traditional Marketing:

- Luxury real estate publications (Atlanta Magazine, Atlanta Homes & Lifestyles)

- Direct mail to high-net-worth zip codes (Buckhead, Sandy Springs, etc.)

- Broker events and tours (inviting top-producing agents)

- Signage and property brochures (high-quality materials only)

Network Leverage:

- Personal outreach to known luxury buyers in my network

- Referral partner connections (wealth managers, attorneys, CPAs)

- Luxury agent networks (connections in feeder markets)

- Country club and social connections (where luxury buyers congregate)

One of my $2.4M listings never hit public MLS—I marketed it privately to my network and luxury agent contacts. We had a buyer under contract within 11 days at full asking price, no contingencies, 30-day close. That's the power of strategic luxury marketing.

Negotiation and Terms: Beyond Just Price

Luxury negotiations involve more than price—terms often matter as much or more:

Strategic Term Considerations:

- Close timing: Flexibility can be worth $50K-$100K to right buyer

- Furniture and equipment: Boats, furnishings, equipment can sweeten deals

- Contingencies: Fewer contingencies worth price consideration

- Inspection periods: Shorter periods reduce uncertainty

- Earnest money: Higher earnest money demonstrates buyer commitment

I recently negotiated a deal where the buyer offered $1.95M with 60-day close (my seller's preference) versus a $2.02M offer with 120-day close. We took the lower offer because timing was critical to my seller's relocation. Terms matter—sometimes more than price.

Frequently Asked Questions About Lake Lanier Luxury Real Estate

What qualifies as "luxury" on Lake Lanier?

Lake Lanier luxury real estate is generally defined as properties priced at $1 million and above. However, true luxury encompasses more than just price—it includes exceptional location (deep water main channel frontage), premium amenities (dock permits, pools, outdoor entertainment spaces), superior construction quality, and sought-after communities. The luxury segment represented 47% of all Lake Lanier sales in 2024, with 149 properties sold at an average price of $1.3 million.

How much does a dock permit add to property value on Lake Lanier?

A dock permit adds $100,000 to $400,000 to Lake Lanier property values, depending on dock type and water depth. Single-slip docks add a minimum of $50,000+, while double-slip docks in deep water locations can add $100,000-$200,000 or more. The Army Corps of Engineers capped total permits at 10,615 in 2004, and all permits have been allocated, making existing permits extremely valuable. The scarcity premium continues to increase as demand grows and supply remains fixed.

Which Lake Lanier communities command the highest luxury prices?

Harbour Point Yacht Club commands the highest luxury prices ($1M-$3M+) due to 256 covered boat slips exclusively for residents, an 8,000+ sq ft clubhouse, and comprehensive resort amenities. Arden on Lanier - Waterside represents ultra-luxury new construction ($2M-$3M+) with custom homes on 1+ acre lots. Marina Bay ($800K-$1.5M+) offers established luxury with renovation opportunities. Northridge Estates ($950K-$1.4M) provides north-end luxury value. South-end communities generally command $200,000-$500,000 premiums over comparable north-end properties.

Is Lake Lanier luxury real estate a good investment?

Lake Lanier luxury real estate has proven to be a strong investment with 73% appreciation over 10 years (2014-2024) and consistent 6-8% annual appreciation in the luxury segment. The market benefits from limited supply (10,615 dock permit cap), strong lifestyle demand from remote workers, and cash buyer dominance (50% of luxury buyers) providing stability. However, investors should plan to hold 5+ years, budget for higher maintenance costs ($15K-$30K annually), and understand seasonal market dynamics. Rental income potential ranges from $45,000-$120,000 annually depending on property and rental strategy.

What's the best time to buy luxury Lake Lanier property?

The best time to buy luxury Lake Lanier property is January-March when buyer competition is lowest and motivated sellers offer the best negotiating leverage. Winter buying allows you to see properties during low water levels, revealing true dock functionality and water access. However, inventory is limited during winter. Spring (April-May) offers increasing inventory with still-reasonable negotiating position. Summer (June-August) sees peak competition with multiple offers common but maximum property selection. September-November provides moderate activity and balanced opportunities.

How do Lake Lanier luxury properties compare to other Georgia luxury markets?

Lake Lanier luxury properties offer unique value compared to metro Atlanta luxury markets. While Buckhead luxury homes average $500-$700/sq ft, Lake Lanier luxury averages $330-$450/sq ft—providing 30-40% more square footage per dollar. Additionally, Lake Lanier offers waterfront recreation impossible in urban luxury markets. The market shows stronger appreciation (6-8% annually) than many Georgia luxury segments due to supply constraints. However, Lake Lanier requires accepting seasonal water level fluctuations and more distance from urban amenities.

What should I look for when buying a luxury Lake Lanier home?

When buying luxury Lake Lanier property, prioritize: Dock permit verification (confirm it's current, transferable, and properly documented), deep water access (10+ feet during winter pool for year-round functionality), location within the lake (south-end commands premiums but north-end offers value), view quality (open water and sunset orientation add significant value), construction quality (inspect foundation, roof, systems carefully), smart home technology (essential for remote workers), and community amenities (gated communities with resort features command premiums). Always view properties during winter pool to understand worst-case water conditions.

How long do luxury Lake Lanier properties take to sell?

Luxury Lake Lanier properties average 69 days on market, though properly priced properties in premier communities like Harbour Point often sell within 2-3 weeks. Market timing significantly affects sale speed: properties listed during full pool (May-August) sell 15-30% faster than those listed during winter drawdown. Well-priced luxury homes under $1.5M in desirable locations can generate multiple offers within 7-14 days during peak season. Properties above $2M typically require 60-120 days to find the right buyer, though exceptional properties occasionally sell much faster.

What are the ongoing costs of owning luxury Lake Lanier property?

Annual luxury Lake Lanier ownership costs range from $38,000-$98,000+ including: property taxes ($12,000-$35,000+), insurance ($4,000-$10,000+ for waterfront), dock maintenance ($2,000-$5,000), landscaping ($5,000-$15,000), utilities ($4,000-$8,000), HOA/lake fees ($1,000-$5,000), and maintenance reserves ($10,000-$20,000). This excludes mortgage payments. Luxury waterfront properties require higher budgets than non-waterfront due to dock upkeep, specialized insurance, Corps regulations compliance, and enhanced landscaping standards. Buyers should qualify for ownership costs, not just purchase price.

Can I rent my luxury Lake Lanier property for income?

Yes, luxury Lake Lanier properties offer strong rental income potential. Summer peak season (May-August) commands $6,000-$15,000/month, shoulder season (April, Sept-Oct) generates $4,000-$8,000/month, and winter (Nov-March) produces $3,000-$6,000/month. Conservative rental approach (6 months rented) generates $45,000-$75,000 gross annually. Aggressive approach (9+ months) can produce $70,000-$120,000 gross annually. After operating expenses (30-40% of gross), net income ranges $30,000-$75,000 annually. Combined with 6-8% appreciation, total returns can exceed 10% annually while maintaining personal use.

What's driving the surge in Lake Lanier luxury sales?

The 46% surge in luxury Lake Lanier sales is driven by multiple factors: remote work transformation allowing high-income professionals to live lakefront while maintaining careers, limited supply dynamics with dock permit cap of 10,615 and no new waterfront development, lifestyle migration from urban areas to resort destinations, cash buyer dominance (50% of luxury buyers) insulating the market from interest rate impacts, scarcity premium increasing as demand outpaces fixed supply, and Atlanta proximity (30-45 minutes) allowing luxury lifestyle without sacrificing business connections. These structural advantages support continued luxury market strength.

Are there luxury Lake Lanier properties under $1 million?

While "luxury" is generally defined as $1M+, high-quality Lake Lanier properties exist in the $800K-$1M range, particularly in the north end or in communities like Marina Bay that need updates. These properties typically offer: established communities with good amenities, older homes (20+ years) requiring modernization, smaller lot sizes or less desirable cove locations, and opportunity to create value through strategic renovation. Investing $150K-$250K in updates can transform an $875K property into a $1.2M+ luxury home. For buyers willing to renovate, this price range offers excellent value creation opportunity.

How does location affect luxury property values on Lake Lanier?

Location creates dramatic value differences on Lake Lanier. South-end locations (Flowery Branch, Buford) command $200,000-$500,000 premiums due to 20-30 minute Atlanta proximity, highest buyer demand, and best amenities. Gainesville area offers balance with convenient access to services at moderate premiums. North-end provides privacy and mountain views with relative value—comparable homes cost 20-30% less than south-end. Within locations, main channel deep water frontage adds $300,000-$500,000 over cove properties, sunset orientation adds $25,000-$100,000, and open water views command significantly higher prices than wooded or limited-view properties.

What luxury amenities are most important to Lake Lanier buyers?

Top luxury amenities driving Lake Lanier buyer decisions include: private dock permits with deep water access (adds $100K-$400K value), infinity pools overlooking the lake (returns $150K-$300K value from $100K-$200K investment), gourmet kitchens with Wolf/Sub-Zero appliances (expected standard at $1M+), outdoor entertainment spaces with kitchens, fire features, and weatherproof AV, smart home technology and whole-house generators (essential for remote workers), multiple master suites (main floor + upstairs increasingly common), and covered boat slips in gated communities (provides year-round protection and security). Properties lacking these amenities often require significant price discounts.

Should I buy luxury Lake Lanier property now or wait?

Current market conditions favor buying luxury Lake Lanier property now for several reasons: inventory remains constrained with limited new luxury listings, prices continue appreciating 6-8% annually (waiting costs potential equity), interest rates stabilizing after recent increases, remote work trends accelerating demand from high-income professionals, and cash buyer dominance (50%) indicates financial strength supporting prices. However, consider waiting if: you're not financially comfortable with current prices, you can't accept seasonal water level fluctuations, or you need perfect market timing for other financial reasons. Long-term (5+ years), Lake Lanier luxury has consistently appreciated regardless of entry timing.

Ready to explore Lake Lanier's luxury real estate market with an expert who's successfully closed millions in luxury transactions? Contact Beka at bekasells.com for personalized guidance on buying or selling luxury Lake Lanier property. I'll help you navigate this sophisticated market and achieve your luxury real estate goals.

Categories

Recent Posts