Lake Lanier Property Taxes (2025): County-by-County Guide + Savings Tips

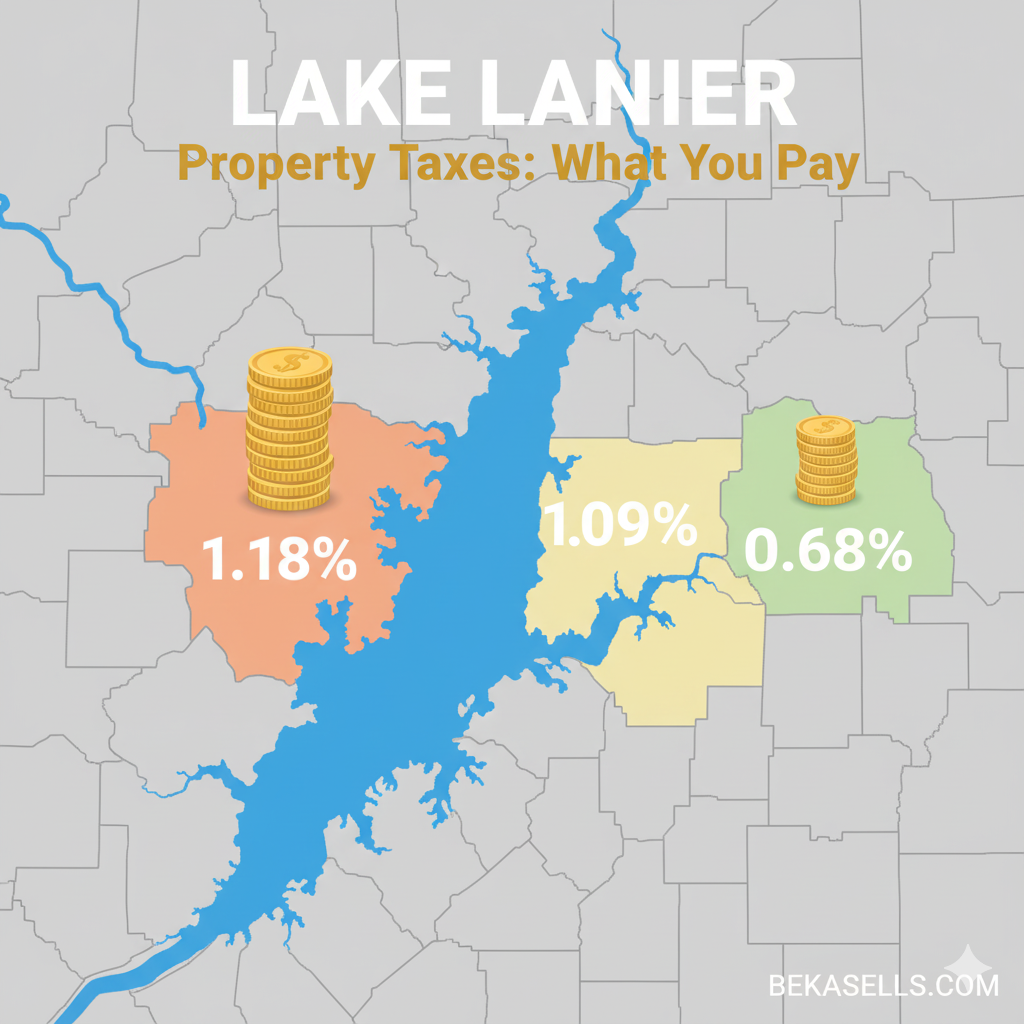

Lake Lanier property taxes vary dramatically by county, ranging from 0.68% effective rate in Dawson County to 1.18% in Forsyth County. A $500,000 lake home will cost approximately $3,400-$5,900 annually in property taxes depending on location. All Georgia counties assess at 40% of fair market value, then apply county-specific millage rates. Strategic county selection can save $2,000-$3,000+ annually on identical home values, making location choice critical for long-term affordability.

I'll never forget sitting across from a buyer who had found their perfect Lake Lanier home—gorgeous views, deep water access, move-in ready. Then the property tax reality hit. They'd been comparing a $650,000 home in Forsyth County ($7,670 annual taxes) to a similar home in Dawson County ($4,420 annual taxes). That's a $3,250 annual difference—over $97,500 over 30 years of ownership.

After helping over 100+ families purchase Lake Lanier properties and nearby, I've learned that property taxes are one of the most overlooked costs in the buying decision. Buyers focus on mortgage payments and home inspection costs, but fail to calculate the long-term tax impact of their location choice.

In this comprehensive guide, I'm breaking down exactly what you'll pay in property taxes across every Lake Lanier county. Whether you're buying a $500K starter lake home or a $3M luxury estate, understanding these tax differences will save you thousands of dollars annually.

About the Author: Beka Rickman

Beka Rickman is a Lake Lanier tax strategy advisor and licensed agent with Beka & Associates Real Estate (GA License ID 361599) who has saved clients over $200,000 in lifetime tax obligations through strategic county selection. With effective rates ranging from 0.68% in Dawson County to 1.18% in Forsyth County, she shows buyers how a $1M home can cost $6,800 annually in one county versus $11,800 in another—a $5,000 yearly difference totaling $150,000 over 30 years. She also analyzes school districts, commute times, and service levels to help clients choose the right shoreline for both lifestyle and long-term wealth preservation. See her county comparison tools.

Contact: 404-606-3905 • beka@bekasells.com • Get your personalized tax analysis

4335 South Lee St, Suite D, Buford, GA 30518

Lake Lanier's Six-County Tax Landscape: What You Need to Know

Lake Lanier spans six primary counties in North Georgia, and each county has completely different tax structures, assessment methods, and millage rates. This isn't a minor detail—it's a major financial decision that affects your monthly budget and long-term wealth.

The Six Lake Lanier Counties:

- Forsyth County (Cumming area) - Highest taxes, best proximity to Atlanta

- Hall County (Gainesville and Buford areas) - Moderate-high taxes, good amenities

- Gwinnett County (limited lake frontage) - Complex tax structure

- Dawson County (Dawsonville area) - Lowest taxes, north-end location

- Lumpkin County (Dahlonega area) - Very low taxes, mountain views

- Habersham County (Clarkesville area) - Low taxes, furthest from Atlanta

Why County Selection Matters More Than You Think:

I've worked with clients who saved $200,000+ on their home purchase by choosing a north-end county, only to discover they're saving another $3,000-$4,000 annually on property taxes. Over 30 years of ownership, that's an additional $90,000-$120,000 in savings—enough for a boat, dock upgrades, or a healthy retirement fund.

Understanding these tax variations is as important as negotiating your purchase price. Let me break down exactly what you'll pay in each county.

How Georgia Property Taxes Actually Work: The Foundation

Before diving into county-specific rates, you need to understand Georgia's property tax calculation system. Every county follows the same basic formula, but the devil is in the details.

The Georgia Property Tax Formula

Step 1: Assessment Rate (40% Statewide Standard) Georgia assesses all properties at 40% of fair market value. This is uniform across all counties—no exceptions.

Example: $500,000 home × 40% = $200,000 assessed value

Step 2: Apply Exemptions Homestead exemptions and other qualifying exemptions reduce your taxable assessed value.

Example: $200,000 assessed value - $40,000 homestead exemption = $160,000 taxable value

Step 3: Apply Millage Rate Each county (and city within counties) sets millage rates applied to taxable value. One mill = $1 per $1,000 of assessed value.

Example: $160,000 taxable value × 25 mills = $160 × 25 = $4,000 annual tax

Complete Formula: Annual Property Tax = [(Fair Market Value × 40%) - Exemptions] × Millage Rate

This seems straightforward until you realize millage rates vary from 17 mills to 40+ mills depending on county and location. That's where the massive cost differences emerge.

Forsyth County Property Taxes: Premium Location, Premium Price

Forsyth County commands the highest property tax rates around Lake Lanier, but delivers proximity to Atlanta and excellent services in return.

Forsyth County Tax Breakdown

Effective Tax Rate: 1.18% Median Home Value: $350,550 Median Annual Tax Bill: $3,982

What This Means for Lake Lanier Properties:

| Home Value | Assessed Value (40%) | Annual Tax (approx.) | Monthly Impact |

|---|---|---|---|

| $500,000 | $200,000 | $5,900 | $492 |

| $750,000 | $300,000 | $8,850 | $738 |

| $1,000,000 | $400,000 | $11,800 | $983 |

| $1,500,000 | $600,000 | $17,700 | $1,475 |

| $2,000,000 | $800,000 | $23,600 | $1,967 |

These estimates assume no homestead exemption. Actual taxes will be lower with exemptions applied.

Why Forsyth County Taxes Are Higher:

- Prime location - 20-30 minute commute to Atlanta

- Excellent schools - Top-rated Forsyth County School System

- Superior infrastructure - Well-maintained roads, parks, services

- Higher service levels - More comprehensive county services

- Strong demand - Limited supply drives property values and assessments

Real-World Example:

I recently closed on a $1.2M Forsyth County lakefront property for clients relocating from California. Annual property taxes: $14,160. They were shocked—in California, the same home would cost $18,000+ annually. Perspective matters, but compared to other Lake Lanier counties, Forsyth is definitely premium-priced.

Forsyth County Homestead Exemption:

Forsyth offers standard state homestead exemption reducing assessed value. Must be filed by April 1st and property must be your primary residence as of January 1st. This typically saves $800-$1,500 annually depending on exemption amount.

Strategic Considerations for Forsyth County Buyers

When Forsyth Makes Sense:

- You need proximity to Atlanta for work (saves commute time/cost)

- School quality is a priority (Forsyth schools are excellent)

- You value convenience and services

- Property appreciation historically strong (may offset higher taxes)

- You're in higher income bracket (taxes more manageable relative to income)

When to Consider Alternatives:

- You're retired or fully remote (proximity less valuable)

- Every dollar of ongoing costs matters

- You prefer privacy over convenience

- You want to maximize your purchase budget

One of my luxury buyers chose Forsyth specifically because the 25-minute Atlanta commute was worth $4,000/year in extra taxes. They valued time over money. Another client chose Dawson County for identical views at $3,000/year less in taxes—they were retired and rarely drove to Atlanta. Both made the right decision for their situation.

Hall County Property Taxes: The Middle Ground

Hall County offers a balanced approach—moderate taxes with good services and convenient Gainesville location.

Hall County Tax Breakdown

Effective Tax Rate: 1.09% Median Home Value: $259,200 Median Annual Tax Bill: $2,651 2024 Unincorporated Millage Rate: 23.812 mills

Lake Lanier Property Tax Calculator for Hall County:

| Home Value | Assessed Value (40%) | Annual Tax (approx.) | Monthly Impact |

|---|---|---|---|

| $500,000 | $200,000 | $5,450 | $454 |

| $750,000 | $300,000 | $8,175 | $681 |

| $1,000,000 | $400,000 | $10,900 | $908 |

| $1,500,000 | $600,000 | $16,350 | $1,363 |

| $2,000,000 | $800,000 | $21,800 | $1,817 |

Estimates before exemptions. Actual taxes lower with homestead exemption.

Hall County's Unique Waterfront Assessment:

Here's something many buyers don't know: Hall County calculates Lake Lanier property taxes partially based on linear feet of waterfront. More waterfront footage can increase your assessment beyond just square footage and amenities.

I've seen identical homes with different tax bills because one has 150 feet of waterfront while the other has 80 feet. The difference? Approximately $800-$1,200 annually. Factor this into your property search—corner lots with dual water exposure may be beautiful, but they cost more in annual taxes.

Hall County Assessment Considerations:

- Water access and depth affect valuation

- Dock permits increase assessed value

- Lake views from home add premium

- Cove vs. open water location impacts assessment

- Seasonal water level fluctuations don't typically adjust assessments

Hall County Homestead Exemption

Standard Georgia homestead exemption applies, reducing taxable assessed value. File by April 1st for current tax year. Automatically renews once approved.

Tax Bill Timeline:

- Bills mailed: August-September

- Payment due: November 15th

- Late penalties: 5% every 120 days up to 20% maximum

Strategic Hall County Insights:

Hall County is my "Goldilocks zone"—not too expensive (like Forsyth), not too remote (like Lumpkin/Habersham), and offering excellent Gainesville amenities. For buyers who want convenience without paying Forsyth premiums, Hall County delivers.

I often recommend Hall County for:

- Families prioritizing schools AND budget

- Buyers wanting amenity access (shopping, dining, healthcare)

- Those with occasional Atlanta commutes (40-50 minutes reasonable)

- Investment properties (strong rental demand due to location)

One client purchased a $875K Hall County property instead of a $950K Forsyth property of similar quality. They saved $75K on purchase AND $1,200 annually on taxes. That's smart buying.

Gwinnett County Property Taxes: Limited But Complex

Gwinnett County has minimal Lake Lanier frontage, but those lucky properties face complex tax structures worth understanding.

Gwinnett County Tax Structure

2024 County Millage Rate: 6.95 mills (county operations only) Total Millage Rate: 14.71 to 39.86 mills (depending on location and services)

Gwinnett's complexity comes from layered millage rates:

- County operations: 6.95 mills

- School district: Varies by location

- Fire/EMS services: Additional mills

- Police services: Additional mills

- Development authorities: Additional mills

- City taxes: If in incorporated area

Why This Matters:

Two Gwinnett homes worth $600,000 can have annual tax differences of $3,000+ simply based on whether they're in incorporated vs. unincorporated areas, which fire district, and which school zone.

Gwinnett Lake Lanier Properties:

Limited lake frontage means limited inventory. Most Gwinnett lakefront properties are in the Buford area, often carrying some of the highest tax burdens due to city taxes plus county taxes.

My Gwinnett Advice:

Unless you specifically need Gwinnett schools or location, the complex tax structure and limited lake inventory make other counties more attractive. I rarely recommend Gwinnett for Lake Lanier purchases unless there's a compelling personal reason (existing business, family ties, etc.).

Dawson County Property Taxes: The Value Leader

Dawson County offers the lowest property tax rates around Lake Lanier, making it incredibly attractive for luxury buyers maximizing their budget.

Dawson County Tax Breakdown

Effective Tax Rate: 0.68% (2024 data) Median Home Value: $312,600 Median Annual Tax Bill: $2,140

This Is Where Things Get Interesting:

| Home Value | Assessed Value (40%) | Annual Tax (approx.) | Monthly Impact | Forsyth Difference |

|---|---|---|---|---|

| $500,000 | $200,000 | $3,400 | $283 | Save $2,500/year |

| $750,000 | $300,000 | $5,100 | $425 | Save $3,750/year |

| $1,000,000 | $400,000 | $6,800 | $567 | Save $5,000/year |

| $1,500,000 | $600,000 | $10,200 | $850 | Save $7,500/year |

| $2,000,000 | $800,000 | $13,600 | $1,133 | Save $10,000/year |

Let that sink in: A $1.5M home in Dawson County saves you $7,500 annually compared to the same home in Forsyth County. Over 30 years, that's $225,000 in tax savings alone.

Why Dawson County Taxes Are So Low:

- Lower service levels - Fewer county services than Forsyth/Hall

- Smaller government - Lean operations keep millage low

- Rural character - Less infrastructure to maintain

- Lower property values historically - Though lakefront is changing this

- Tax-conscious leadership - County prioritizes keeping rates low

The Dawson County Trade-Off:

Lower taxes come with trade-offs:

- 45-60 minute Atlanta commute (vs. 25 minutes from Forsyth)

- Fewer shopping/dining options (Dawsonville is small town)

- More rural setting (appealing to some, isolating to others)

- Limited county services (but most residents prefer this)

Real Success Story:

I helped a tech executive relocating from Seattle find a $1.8M custom home in Dawson County. Annual taxes: $12,240. An equivalent home in Forsyth would cost $21,240 annually—a $9,000 difference. Since he works remotely, the location trade-off was irrelevant. He invested the tax savings in dock upgrades and a boat. Smart money management.

Dawson County Homestead Exemption

Standard state homestead exemption applies, typically saving $1,000-$2,000 annually on lake properties. File by April 1st annually.

When Dawson County Makes Perfect Sense:

- You're retired or fully remote

- You prioritize privacy and nature over convenience

- Every dollar of ongoing cost matters for your budget

- You rarely commute to Atlanta

- You want to maximize home purchase budget (lower taxes = qualify for more house)

For luxury buyers especially, Dawson County's tax savings can be substantial enough to upgrade from $1.5M to $1.8M budget range while maintaining similar monthly costs.

Lumpkin County Property Taxes: Mountain Views, Low Taxes

Lumpkin County (Dahlonega area) combines low property taxes with stunning mountain views—a compelling value proposition for the right buyer.

Lumpkin County Tax Breakdown

Effective Tax Rate: 0.85% Median Home Value: $262,184 Median Annual Tax Bill: $1,669

Lake Lanier Properties in Lumpkin County:

| Home Value | Assessed Value (40%) | Annual Tax (approx.) | Monthly Impact | Forsyth Difference |

|---|---|---|---|---|

| $500,000 | $200,000 | $4,250 | $354 | Save $1,650/year |

| $750,000 | $300,000 | $6,375 | $531 | Save $2,475/year |

| $1,000,000 | $400,000 | $8,500 | $708 | Save $3,300/year |

| $1,500,000 | $600,000 | $12,750 | $1,063 | Save $4,950/year |

Lumpkin County's Unique Appeal:

- Historic Dahlonega charm - Gold rush town with character

- Mountain views - North Georgia mountains backdrop

- Wine country proximity - Dahlonega wine region

- Lower cost of living - Everything costs less, not just taxes

- Below national median - 0.85% vs. 1.02% national average

The Location Consideration:

Lumpkin County is the furthest north of the major Lake Lanier counties. You're looking at:

- 60-75 minutes to Atlanta (depending on traffic)

- 20-30 minutes to Gainesville (for major shopping)

- Isolated but scenic setting

- True mountain lake experience

Who Should Consider Lumpkin County:

- Retirees seeking peaceful mountain setting

- Weekend users who don't need nearby amenities

- Nature enthusiasts who value scenery over convenience

- Budget-conscious buyers maximizing purchase power

- Those seeking the "vacation home" feel year-round

I have several clients who purchased Lumpkin County properties as primary residences after retirement. The combination of low taxes, mountain views, and small-town Dahlonega charm creates a lifestyle they couldn't find elsewhere at this price point.

Lumpkin County Exemptions and Deadlines

Standard homestead exemption applies. Additional senior exemptions available for residents 65+ with qualifying income limits.

Payment Schedule:

- Tax bills mailed: August-September

- Due date: November 15th

- Late penalty: 5% increments up to 20% maximum

Habersham County Property Taxes: The Northeast Corner

Habersham County (Clarkesville area) represents the northeast corner of Lake Lanier with competitive tax rates and the most rural setting.

Habersham County Tax Breakdown

Effective Tax Rate: 0.99% Median Home Value: $168,150 Median Annual Tax Bill: $1,201

Lake Properties in Habersham County:

| Home Value | Assessed Value (40%) | Annual Tax (approx.) | Monthly Impact |

|---|---|---|---|

| $500,000 | $200,000 | $4,950 | $413 |

| $750,000 | $300,000 | $7,425 | $619 |

| $1,000,000 | $400,000 | $9,900 | $825 |

Habersham County Characteristics:

- Most remote location - Furthest from Atlanta (75-90 minutes)

- Lowest median home values - Reflects rural nature

- Competitive tax rates - Below national average

- Clarkesville charm - Small mountain town appeal

- Limited lake inventory - Fewer properties available

Habersham County Reality Check:

Habersham works for a very specific buyer:

- Extremely remote work or retired (long Atlanta commute impractical)

- Seeking privacy and isolation

- Weekend/vacation home users from Atlanta

- Value-oriented buyers accepting location trade-offs

I rarely show Habersham properties to primary residence buyers because the commute to anywhere is significant. However, for weekend retreat buyers, the combination of low taxes, scenic setting, and relative affordability creates value.

Habersham County Exemptions

Standard Georgia homestead exemption applies. Senior and disability exemptions available for qualifying residents.

Waterfront Property Tax Considerations: What Makes Lake Properties Different

Lake Lanier waterfront properties face unique assessment factors that affect tax calculations across all counties. Understanding these factors helps you anticipate your actual tax bill.

Waterfront Assessment Factors

1. Water Access and Depth Properties with year-round deep water access are assessed higher than those with seasonal or shallow water. Water depth during winter pool affects property functionality and therefore value.

2. Dock Permits and Facilities

- Permitted dock adds $100K-$400K to property value (and therefore assessment)

- Boat lifts and jet ski platforms increase assessed value

- Covered slips add premium

- Double vs. single slip docks create valuation differences

3. Lake Views from Property

- Open water views command highest assessments

- Cove views assessed lower than main channel

- Seasonal view changes (foliage) don't affect assessments

- Sunset orientation adds assessment premium

4. Location: Coves vs. Open Water

- Main channel frontage highest assessment

- Protected coves lower assessment but potentially better for families

- Navigation access to main lake affects value

5. Seasonal Water Level Fluctuations County tax assessors generally don't adjust for seasonal water levels, though severe multi-year droughts may eventually affect assessments through appeals.

6. Army Corps of Engineers Regulations Properties in full compliance with Corps regulations maintain higher assessments than those with compliance issues.

Waterfront Assessment Example

Property A: Deep Water Main Channel

- $800K purchase price

- Year-round navigation

- Panoramic water views

- Permitted double-slip dock

- Assessed at full $800K

Property B: Shallow Cove

- $800K purchase price

- Seasonal dock access only

- Limited cove views

- Single-slip dock

- May be assessed at $750K-$775K (slightly lower due to limitations)

The difference? $500-$1,250 annually in taxes on identically priced properties.

Available Property Tax Exemptions: Reducing Your Tax Burden

Every Lake Lanier county offers exemptions that can significantly reduce your annual tax bill. Many buyers miss thousands in savings by not properly claiming exemptions.

Georgia Homestead Exemption

The standard Georgia Homestead Exemption is available in all Lake Lanier counties and provides the most significant tax relief.

Key Requirements:

- Property must be your primary residence

- You must own and occupy the property as of January 1st

- Must file by April 1st for the current tax year

- Automatically renews annually once approved

- Cannot claim homestead on multiple properties

How Much You'll Save:

Homestead exemptions vary by county but typically reduce assessed value by:

- $25,000-$50,000 off assessed value (varies by county)

- Annual savings: $800-$2,000+ depending on millage rate and exemption amount

Application Process:

- File with county tax assessor by April 1st

- Provide proof of ownership and residency

- Show driver's license with property address

- One-time application (auto-renews unless ownership changes)

My Client Example:

I had a client who forgot to file for homestead exemption the first year after purchase. Their tax bill? $12,400. After filing exemption the following year, it dropped to $10,600—a $1,800 annual savings they missed the first year. Don't make this mistake!

Senior Citizen Exemptions

Most Lake Lanier counties offer additional exemptions for seniors age 62-65+ (varies by county).

Typical Senior Exemptions:

- Additional assessed value reduction beyond standard homestead

- Income limits may apply (usually $30,000-$50,000 threshold)

- Can combine with standard homestead for maximum savings

- Must reapply or verify annually in some counties

Potential Savings: $500-$1,500 additional annual savings for qualifying seniors

Strategic Consideration:

If you're approaching retirement age and buying Lake Lanier property, factor senior exemptions into your long-term tax planning. A property that seems expensive tax-wise today may become very affordable with senior exemptions in a few years.

Disability Exemptions

Qualifying disabled veterans and disabled homeowners may receive additional exemptions.

Eligibility Varies by County:

- Veteran disability percentage requirements

- Documentation from VA or medical providers

- Income limitations may apply

- Can combine with other exemptions

Savings: $500-$2,000+ annually depending on county and disability rating

Local Exemptions Beyond State Minimums

Some counties offer additional local exemptions providing further tax relief:

- Agricultural exemptions (if you maintain qualifying farm use)

- Conservation easements (for preserving land)

- Historic property exemptions (for qualified historic homes)

Check with your specific county tax assessor for all available exemptions. Many people leave money on the table by not exploring every option.

Property Tax Payment Schedules and Deadlines: Avoid Penalties

Understanding payment schedules helps you budget and avoid costly late penalties.

Standard Lake Lanier Tax Calendar

January 1st:

- Property assessment date

- Must own and occupy property by this date for homestead exemption

- New property returns due (for new construction or significant changes)

January 1st - April 1st:

- File homestead exemptions for current tax year

- File appeals for property assessments

- New property return deadline: April 1st

May - June:

- Assessment notices mailed

- Board of Equalization appeal period (if you disagree with assessment)

- Appeals typically heard May through June

August - September:

- Tax bills mailed to property owners

- Bills include full year tax amount

- Review bill carefully for accuracy

November 15th (varies slightly by county):

- Payment deadline for most Lake Lanier counties

- Some counties offer small discounts for early payment

- Online payment options available in all counties

After November 15th:

- Late penalties begin accruing

- Typical penalty: 5% immediately upon late payment

- Additional 5% every 120 days up to 20% maximum penalty

- Interest accrues on unpaid balance

Late Payment Cost Example

$10,000 Tax Bill Paid Late:

- December payment: $10,500 (5% penalty)

- April payment: $11,000 (10% penalty)

- August payment: $11,500 (15% penalty)

- December payment: $12,000 (20% maximum penalty)

Don't let a missed deadline cost you $500-$2,000 in unnecessary penalties. Set calendar reminders or arrange autopay where available.

Payment Options

All Lake Lanier counties now offer:

- Online payment through county tax commissioner websites

- Mail payment (postmark by deadline)

- In-person payment at county tax office

- Installment plans in some cases (contact tax commissioner)

- Escrow payment through mortgage lender (most common)

My Strong Recommendation:

If you have a mortgage, use escrow for property tax payments. Your lender collects 1/12 of annual taxes monthly, ensures timely payment, and you never risk penalties. This is how 90% of my clients handle property taxes.

Strategic Tax Planning for Lake Lanier Buyers

Smart buyers factor property taxes into every decision—from county selection to property type to long-term financial planning.

Strategy #1: Choose Your County Wisely

The Single Biggest Tax Decision:

County selection can save or cost you $2,000-$10,000 annually on identical home values. Here's my strategic framework:

Choose Forsyth County If:

- Atlanta proximity is worth the premium (daily commute)

- You prioritize top schools and services

- Higher income makes tax burden manageable

- Property appreciation potential matters (historically strong)

- Convenience and amenities are priorities

Choose Hall County If:

- You want balance between cost and convenience

- Gainesville amenities are sufficient for your needs

- Occasional Atlanta trips (40-50 minutes acceptable)

- Good schools matter but budget is important

- Investment properties (rental demand strong)

Choose Dawson County If:

- You're retired or fully remote (no commute needs)

- Tax savings are a priority (lowest rates)

- Privacy and nature over convenience

- You want to maximize home purchase budget

- Occasional trips to civilization are fine

Choose Lumpkin County If:

- Mountain views and wine country appeal

- You prioritize low taxes and low cost of living

- Small-town Dahlonega charm fits your lifestyle

- 60-75 minute drive to Atlanta is acceptable

- You want a "vacation home" feeling year-round

My Client Success Story:

I worked with a couple relocating from Chicago. They initially targeted Forsyth County for schools. After I showed them Hall County properties with similar school ratings and $2,400 annual tax savings, they switched focus. Found their dream home in Hall, saved on purchase price AND taxes, and are thrilled with the decision.

Strategy #2: Maximize All Available Exemptions

Don't Leave Money on the Table:

I've seen clients miss $1,500-$3,000 annually in tax savings by not properly claiming exemptions. Here's your action plan:

Upon Closing:

- File homestead exemption immediately (by April 1st deadline)

- Research all county-specific exemptions available

- If 62+, file senior exemption (if eligible)

- Veterans: verify disability exemption eligibility

- Check for special local exemptions (agricultural, conservation, etc.)

Annual Review:

- Verify exemptions are properly applied each year

- Check for new exemptions you've become eligible for

- Review tax bill carefully for accuracy

- Update exemptions if circumstances change

Example Savings Stack:

- Standard homestead: -$1,200/year

- Senior exemption: -$800/year

- Veteran disability: -$600/year

- Total annual savings: $2,600

That's $78,000 over 30 years—real money!

Strategy #3: Consider Assessment Appeals

If you believe your property is overassessed relative to comparable properties, you can appeal to the county Board of Equalization.

When to Consider an Appeal:

- Your assessment increased dramatically (15%+) while neighbors didn't

- Recent comparable sales are lower than your assessed value

- Property has defects affecting value not reflected in assessment

- Water access limitations not properly considered

- Inspection revealed issues that weren't present during assessment

Appeal Process Timeline:

- Assessment notices: May-June

- Appeal filing deadline: Typically 45 days from notice

- Board of Equalization hearings: June-July

- Decision: Usually within 30 days of hearing

What You Need for Successful Appeal:

- Recent comparable sales (same area, similar properties, lower values)

- Professional appraisal supporting your position (cost: $400-$600)

- Photos and documentation of property defects

- Evidence of assessment errors or inconsistencies

Success Rate and Impact:

Successful appeals typically reduce assessments by 5-15%, translating to $300-$1,500+ annual savings. Given the cost of professional appraisal ($400-$600), the investment often pays for itself in one year.

I've helped clients successfully appeal when:

- Lake access was overvalued (dock in shallow cove assessed like main channel)

- Assessment used sale price from peak market, but market had since declined

- Property had foundation issues not visible during assessment

Strategy #4: Factor Taxes Into Purchase Budget

The Complete Cost Calculation:

Too many buyers focus solely on mortgage payments without considering the full monthly cost including property taxes.

Example Property Analysis:

- Purchase price: $750,000

- 20% down: $150,000

- Loan amount: $600,000

- Interest rate: 7%

- Mortgage payment (P&I): $3,992/month

Now Add Property Taxes By County:

| County | Annual Tax | Monthly Tax | Total Monthly | Over Mortgage |

|---|---|---|---|---|

| Forsyth | $8,850 | $738 | $4,730 | +18.5% |

| Hall | $8,175 | $681 | $4,673 | +17.1% |

| Dawson | $5,100 | $425 | $4,417 | +10.6% |

| Lumpkin | $6,375 | $531 | $4,523 | +13.3% |

The Dawson County buyer's monthly cost is $313 LESS than Forsyth County—that's $3,756 annually or $112,680 over 30 years.

Budget Strategy:

If your comfortable payment is $4,500/month, you can afford:

- Dawson County: $780K home (after taxes)

- Forsyth County: $715K home (after taxes)

That's a $65K buying power difference based purely on tax rates!

Strategy #5: Long-Term Tax Planning

Think 30-Year Ownership:

Property taxes compound over time, and small differences become massive over decades.

30-Year Tax Comparison ($1M Home):

| County | Annual Tax | 30-Year Total | Difference from Dawson |

|---|---|---|---|

| Forsyth | $11,800 | $354,000 | +$150,000 |

| Hall | $10,900 | $327,000 | +$123,000 |

| Dawson | $6,800 | $204,000 | Baseline |

| Lumpkin | $8,500 | $255,000 | +$51,000 |

That $150K difference between Forsyth and Dawson? That's a new boat, dock renovation, or healthy retirement fund contribution.

Plan for Tax Increases:

Property taxes typically increase 2-4% annually due to:

- Assessment increases (properties appreciate)

- Millage rate increases (counties raise rates)

- Exemption changes (rarely favorable)

Factor 3% annual increases into your budget:

- Year 1: $10,000

- Year 10: $13,439 (+34%)

- Year 20: $18,061 (+81%)

- Year 30: $24,273 (+143%)

Smart buyers budget for these increases from day one.

Common Property Tax Mistakes Lake Lanier Buyers Make

After working with hundreds of buyers, I've seen these mistakes repeatedly. Learn from others' errors:

Mistake #1: Not Filing Homestead Exemption

The Error: Buyer closes on property and forgets to file homestead exemption by April 1st deadline.

The Cost: $800-$2,000 in unnecessary taxes the first year.

The Solution: File homestead exemption within 30 days of closing. Don't wait until next January.

Mistake #2: Not Factoring Taxes Into Budget

The Error: Buyer focuses only on mortgage payment, then gets shocked by $8,000 tax bill.

The Cost: Budget stress, potential inability to afford monthly costs.

The Solution: Calculate TOTAL monthly cost (mortgage + taxes + insurance + HOA) before making offers. I provide this breakdown for every property my clients consider.

Mistake #3: Choosing County Based Solely on Commute

The Error: Buyer picks Forsyth for 25-minute commute without considering $3,000+ annual tax savings in other counties.

The Cost: $90,000-$150,000 over 30 years of ownership.

The Solution: Calculate the VALUE of commute time. If you work remotely 3 days/week, is 20 minutes twice weekly worth $3,000/year? Probably not.

Mistake #4: Ignoring Water Access in Tax Planning

The Error: Buyer purchases shallow cove property in high-tax county, overpaying for both property AND taxes.

The Cost: Limited water access during low water PLUS high property taxes = double pain.

The Solution: If you're accepting water access limitations, at least minimize tax burden by choosing lower-tax counties. Don't overpay in both directions.

Mistake #5: Not Reviewing Tax Bill Annually

The Error: Homeowner pays tax bill without reviewing for errors or confirming exemptions applied correctly.

The Cost: Overpayments, missed errors, lost exemption savings.

The Solution: Review tax bill carefully each year. Verify:

- Assessed value matches property (no clerical errors)

- All exemptions properly applied

- Millage rate matches county published rate

- No duplicate charges or errors

I've found errors on tax bills resulting in $400-$1,200 overcharges. Counties make mistakes—verify everything.

Frequently Asked Questions About Lake Lanier Property Taxes

How much are property taxes on Lake Lanier homes?

Lake Lanier property taxes vary significantly by county, ranging from 0.68% effective rate in Dawson County to 1.18% in Forsyth County. A $500,000 lake home will cost approximately $3,400-$5,900 annually depending on location. A $1 million home ranges from $6,800 annually in Dawson County to $11,800 in Forsyth County. All Georgia counties assess properties at 40% of fair market value, then apply county-specific millage rates. Strategic county selection can save $2,000-$3,000+ annually, or $60,000-$90,000 over 30 years of ownership. Homestead exemptions reduce taxes by $800-$2,000 annually if the property is your primary residence.

Which Lake Lanier county has the lowest property taxes?

Dawson County has the lowest Lake Lanier property taxes with a 0.68% effective tax rate. A $500,000 home costs approximately $3,400 annually in property taxes in Dawson County, compared to $5,900 in Forsyth County—a $2,500 annual savings. Dawson County's low rates make it attractive for luxury buyers and retirees who don't need proximity to Atlanta. Lumpkin County (0.85%) and Habersham County (0.99%) also offer competitive low rates. The trade-off is distance from Atlanta: Dawson is 45-60 minutes from metro Atlanta versus 25 minutes from Forsyth County. For remote workers and retirees, the tax savings often outweigh the location compromise.

Do I have to pay higher property taxes for waterfront property?

Waterfront Lake Lanier properties are typically assessed higher than comparable non-waterfront homes due to water access premiums. Specific waterfront factors affecting assessments include: dock permits (add $100K-$400K to assessed value), water depth and year-round access, lake views from the property, main channel versus cove location, and boat lift/dock facilities. Hall County specifically calculates taxes partially based on linear feet of waterfront—more waterfront footage increases assessments. However, the base tax rate remains the same; waterfront properties simply have higher assessed values. A $500,000 waterfront home and $500,000 non-waterfront home pay the same rate, but the waterfront property likely represents more actual value and amenities.

How do Lake Lanier property tax exemptions work?

Georgia homestead exemptions are available to all Lake Lanier property owners whose property is their primary residence. You must file by April 1st with your county tax assessor, providing proof of ownership and residency. Homestead exemptions typically reduce assessed value by $25,000-$50,000 (varies by county), saving $800-$2,000+ annually. Additional exemptions available: senior citizen exemptions (age 62-65+, may have income limits, save additional $500-$1,500/year), disability exemptions for veterans and disabled homeowners (save $500-$2,000/year), and local exemptions beyond state minimums. Exemptions automatically renew once approved unless ownership changes. Many buyers miss thousands in savings by not properly claiming all eligible exemptions.

When are Lake Lanier property taxes due?

Lake Lanier property taxes are due November 15th in most counties (Forsyth, Hall, Dawson, Lumpkin, Habersham), though some counties vary slightly. Tax bills are mailed in August-September. Late payments incur a 5% penalty immediately, then additional 5% every 120 days up to 20% maximum penalty. A $10,000 tax bill paid in December costs $10,500 (5% penalty); by August next year it's $11,500 (15% penalty). Most homeowners with mortgages pay through escrow—lender collects 1/12 monthly and ensures timely payment. Property assessment date is January 1st, and homestead exemption applications are due April 1st for the current tax year. Board of Equalization appeals typically occur May-June for assessment disputes.

Can I appeal my Lake Lanier property tax assessment?

Yes, you can appeal your Lake Lanier property tax assessment to the county Board of Equalization if you believe your property is overassessed. File within 45 days of receiving your assessment notice (typically May-June). Successful appeals require: recent comparable sales showing lower values in your area, professional appraisal supporting your position (costs $400-$600), documentation of property defects affecting value, or evidence of assessment errors or inconsistencies. Common successful appeal reasons include water access limitations not properly considered, inspection-revealed issues affecting value, and assessments using peak market prices while market has since declined. Successful appeals typically reduce assessments 5-15%, saving $300-$1,500+ annually. The professional appraisal investment often pays for itself in one year of tax savings.

How do property taxes differ between Forsyth and Dawson County?

Forsyth County has the highest Lake Lanier property taxes (1.18% effective rate) while Dawson County has the lowest (0.68% effective rate). On a $1 million home: Forsyth County taxes are approximately $11,800 annually, while Dawson County taxes are approximately $6,800 annually—a $5,000 annual difference or $150,000 over 30 years. Forsyth offers proximity to Atlanta (25 minutes), excellent schools, and superior services. Dawson offers 45-60 minute Atlanta commute, rural setting, and dramatically lower taxes. For remote workers and retirees, Dawson's tax savings are substantial. For daily commuters prioritizing schools and convenience, Forsyth's premium may be worthwhile. Strategic buyers calculate the value of convenience against long-term tax savings to make informed decisions.

What happens if I don't pay Lake Lanier property taxes?

Failure to pay Lake Lanier property taxes results in immediate penalties and potential property loss. First, a 5% penalty applies immediately after the November 15th deadline, then additional 5% penalties every 120 days up to 20% maximum. Interest accrues on unpaid balances. After extended non-payment (typically 12+ months), the county issues a tax lien against your property. Tax liens accrue additional penalties and interest, appear on credit reports affecting your credit score, and must be paid before selling or refinancing the property. Eventually (typically after 1-2 years of non-payment), the county can initiate tax foreclosure proceedings and sell your property at auction to recover unpaid taxes. If you're struggling with tax payments, contact your county tax commissioner immediately—many counties offer payment plans or hardship options.

Are Lake Lanier property taxes deductible on federal income tax?

Yes, Lake Lanier property taxes are generally deductible on federal income tax returns, subject to IRS limitations. Under current tax law, you can deduct up to $10,000 total in state and local taxes (SALT), which includes property taxes plus state income or sales taxes. For lake property as primary residence, property taxes are fully deductible up to the $10,000 SALT cap. For vacation/second homes, property taxes are also deductible within the same $10,000 combined limit. Investment/rental properties have unlimited property tax deductions as business expenses. High-tax states hit the $10,000 SALT cap quickly—a $650,000 Forsyth County home paying $7,670 in property taxes uses most of the deduction. Consult a tax professional for your specific situation, as deductibility provides partial offset of property tax costs.

How often do Lake Lanier property tax rates change?

Lake Lanier property tax rates can change annually, as each county sets millage rates during their budget process (typically summer). However, Georgia law requires public hearings before millage rate increases, and counties generally change rates modestly (0-5% annually). Your actual tax bill can increase even with unchanged millage rates due to: property value appreciation (assessments increase with market), removal or reduction of exemptions, and additions/improvements to your property. Historically, Lake Lanier property taxes increase 2-4% annually on average. Budget for 3% annual increases in long-term planning. Dramatic millage rate increases are rare but possible during financial crises. Counties must advertise any rate increases as tax increases, creating political pressure to keep rates stable. Monitor your county's budget process and public hearings to stay informed of potential rate changes.

What's the property tax difference between cove and main channel locations?

Main channel Lake Lanier properties typically have higher property tax assessments than cove properties due to premium features: year-round deep water access maintaining dock functionality, panoramic open water views, better navigation to main lake areas, and premium positioning desirable to buyers. The assessment difference ranges from 5-15% on comparable properties. For example, a $1 million main channel home might be assessed at full value ($11,800 Forsyth County taxes), while a $1 million cove property with seasonal limitations might be assessed at $900,000-$950,000 ($10,620-$11,210 taxes). The difference of $590-$1,180 annually reflects the main channel's functional advantages. However, some buyers prefer protected coves for swimming and family use despite higher taxes per functional value. Strategic buyers factor both assessment premiums and property functionality into purchase decisions.

How do Lake Lanier property taxes compare to other Georgia lake properties?

Lake Lanier property taxes are generally competitive with or lower than other premium Georgia lake markets. Lake Oconee luxury properties face similar effective rates (0.7-1.1%) in Greene and Putnam Counties. Lake Hartwell properties in northeast Georgia show comparable rates. However, Lake Lanier offers unique advantages: proximity to Atlanta (30-60 minutes vs. 90+ for other lakes), larger property inventory and market liquidity, and multiple county options allowing tax rate shopping. Other Georgia lakes typically span 1-2 counties, limiting tax optimization opportunities. Lake Lanier's six-county span provides strategic flexibility—buyers can choose low-tax Dawson County or high-service Forsyth County based on priorities. This geographic diversity makes Lake Lanier unique for tax planning compared to Georgia's other luxury lake markets.

Do property improvements increase my Lake Lanier property taxes?

Yes, property improvements increase Lake Lanier property taxes by raising your assessed value. Improvements triggering reassessment include: home additions or square footage increases, new dock construction or dock improvements, pools, outdoor kitchens, and major landscaping, finished basements or bonus rooms, and new boat lifts or significant dock upgrades. You must file a property return with your county between January 1 and April 1 following completion of improvements. The county reassesses your property and adjusts taxes accordingly. For example, adding a $100,000 pool increases assessed value by $40,000 (40% assessment rate), resulting in $472-$2,720 additional annual taxes depending on county millage rates. Strategic buyers time improvements considering tax implications. Some improvements (maintenance, repairs, cosmetic updates) don't trigger reassessment, but substantial additions and new structures always do.

Should I factor property taxes into my Lake Lanier home budget?

Absolutely—property taxes should be central to your Lake Lanier budget planning, not an afterthought. Many buyers focus solely on mortgage payments and get shocked by tax bills. Calculate total monthly cost: mortgage principal and interest, property taxes (divide annual by 12), homeowners insurance, flood insurance if applicable, and HOA fees if applicable. County selection dramatically affects affordability: a $750,000 home in Dawson County costs $425/month in taxes versus $738/month in Forsyth County—a $313 monthly or $3,756 annual difference. Over 30 years, that's $112,680 in tax differences alone. Strategic buyers work backwards: if your comfortable payment is $5,000/month total, you can afford a higher-priced home in low-tax Dawson County versus high-tax Forsyth County. Property taxes represent 15-25% of total monthly housing costs—plan accordingly.

Ready to navigate Lake Lanier property taxes strategically and find the perfect county for your budget? Contact Beka for expert guidance on optimizing your Lake Lanier purchase. I'll help you understand the complete cost picture and find the right balance between location, amenities, and long-term tax efficiency. Visit my blog for more Lake Lanier buying insights.

Categories

Recent Posts