Rent vs Buy Lake Lanier Home: 2025 Financial Analysis & Decision Guide

Last Updated: October 15, 2025

By Beka Rickman, Lake Lanier Waterfront Specialist

Bottom Line Up Front

Renting a Lake Lanier waterfront home costs approximately $6,000–$15,000 monthly for luxury properties, while purchasing requires $240,000–$255,000 upfront for a $1 million home. Despite higher initial costs, ownership generates a $1,048,705 wealth advantage over 10 years through 5.6% annual appreciation and equity accumulation—making it financially superior for buyers committed to 5+ years of lakefront living.

Understanding Lake Lanier Waterfront Property Costs in 2025

With 315 dock-access homes sold in 2024 and average prices reaching $1,159,371 for properties with private docks, Lake Lanier’s waterfront market presents distinct financial considerations when evaluating rent vs buy.

$1,159,371

$955,000

5.6%

209 (best in 6 years)

82 days

Rental Market

- Long-term luxury waterfront: $6,000–$15,000/mo

- Standard lake-access homes: $1,500–$4,000/mo

- Vacation rental rates: $225–$600+/night

- Limited long-term inventory

U.S. Army Corps of Engineers regulations limit new waterfront development, creating durable supply constraints that support long-term appreciation.

Complete Cost Analysis: Renting vs Owning

Rental Expenses

- Base rent (luxury waterfront): $6,000–$15,000

- Utilities: $400–$600 (tenant-paid)

- Renter’s insurance: $50–$100

- Total: $6,450–$15,700/mo

Hidden limitations: annual rent increases (3–8%), zero equity, modification limits, lease restrictions, and relocation risk if the property sells.

Ownership Investment (Sample: $1,000,000 purchase)

| Category | Amount |

|---|---|

| Down payment (20%) | $200,000 |

| Closing costs | $30,000 |

| Inspections | $800–$1,300 |

| Immediate improvements | $10,000–$25,000 |

| Moving expenses | $3,000–$8,000 |

| Total upfront | $243,800–$264,300 |

Monthly ownership costs (estimate): Mortgage (6.3%, 20% down) $4,926 + Taxes $625 + Insurance $459–$584 + HOA $42–$387 + Maintenance/Utilities $883–$1,233 = $6,935–$7,847/mo.

Annual waterfront maintenance: Dock $2,000–$5,000; Seawall $2,000–$4,000; Landscaping $3,000–$6,000 (Total $7,000–$15,000).

Plan proactively for water level swings and compare county property taxes before you buy.

10-Year Financial Comparison

Renting (10 Years)

- Total payments: $1,009,435

- Equity accumulated: $0

- Asset value: $0

Owning (10 Years)

- Total cash outlay: $996,120

- Home value (5.6% CAGR): $1,724,088

- Remaining mortgage: $675,383

- Net equity: $1,048,705

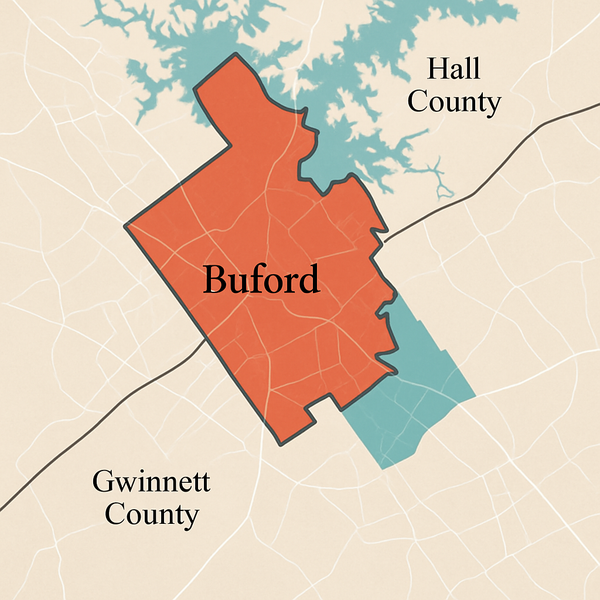

County Tax Comparison (Sample $1M Assessed)

| County | Rate | Annual Tax | 10-Year | Schools |

|---|---|---|---|---|

| Dawson | 0.68% | $6,800 | $68,000 | Good |

| Hall | 0.85% | $8,500 | $85,000 | Very Good |

| Forsyth | 1.18% | $11,800 | $118,000 | Excellent |

| Gwinnett | 1.05% | $10,500 | $105,000 | Excellent |

| Cherokee | 0.92% | $9,200 | $92,000 | Very Good |

Vacation Rental Income Potential

- Luxury waterfront (4+ bed, private dock): $60,000–$100,000/yr

- Standard waterfront (3 bed): $35,000–$60,000/yr

- Lake-access properties: $25,000–$40,000/yr

Example (Gross $70,000): Management (25%) −$17,500; Operating −$12,000; Extra maintenance −$7,000 → Net ≈ $33,500/yr (≈ $2,792/mo effective cost reduction).

Tax Benefits & Deductions

- Mortgage interest: $30,000–$45,000/yr

- Property taxes: $7,500–$11,800/yr

- Total deductions: $37,500–$56,800/yr (24% bracket ≈ $9,000–$13,632 savings)

- Investment property: operating expenses deductible + depreciation (~$27,272/yr)

When to Rent vs Buy

Rent If You…

- Plan < 3–5 years at the lake

- Face career/location uncertainty

- Have < $240,000 liquid

- Want to “test” the lifestyle

- Prefer minimal maintenance

Buy If You…

- Commit to 5+ years

- Household income $150k–$200k+

- $240k+ available for upfront

- Seek long-term wealth/legacy

- Have 6–12 months reserves

Interest Rate Impact

| Rate | Payment (≈$800k loan) | Total Interest | Break-Even |

|---|---|---|---|

| 5.5% | $4,543 | $835,480 | 3.5 yrs |

| 6.3% (current) | $4,926 | $973,360 | 4.0 yrs |

| 7.0% | $5,322 | $1,115,920 | 4.5 yrs |

| 8.0% | $5,870 | $1,313,200 | 5.5 yrs |

North vs South Lake Comparison

North Lake

- Avg luxury: $1.6M

- Deeper year-round water

- Less traffic, more privacy

- 60–90 min to Atlanta

- STR: $400–$600/nt, 50–60% occ.

South Lake

- Avg luxury: $1.2M–$1.5M

- Closer to amenities

- Better schools (Forsyth)

- 30–45 min to Atlanta

- STR: $350–$550/nt, 60–70% occ.

2025 Market Timing

- 209 active listings (best selection in 6 years)

- 6.3% interest rates (stabilizing)

- Realistic seller pricing; 4% YoY appreciation

- Winter buyers often secure 5–10% better pricing

Risk Management

Primary Risks

- Near-term value declines (macro cycles)

- Unexpected major repairs

- Water level fluctuations

- Shoreline/Corps regulation changes

Protection Strategies

- Maintain 6–12 months of reserves

- Comprehensive homeowners & flood coverage

- Budget 1–2%/yr for maintenance

- Use lake-specialist inspectors & agents

- Thorough inspections (inspection essentials)

Essential Professional Team

- Lake specialist realtor (waterfront, Corps knowledge)

- Marine inspector (dock/seawall)

- Insurance specialist (waterfront/flood)

- Mortgage lender (jumbo & waterfront)

- Real estate attorney (easements)

- Tax advisor (deductions/STR rules)

Retirement Considerations

- Fixed costs vs rising rents

- Downsize later to unlock equity

- STR income can supplement retirement

- Legacy & modification control

Frequently Asked Questions

What income is required to buy a Lake Lanier waterfront home?

For a $1M home (20% down, ~6.3%), total monthly costs around $7,000 typically require ~$300k annual income. Buyers earning $150k–$200k can target $600k–$750k price points with proper down payments.

How much should I save before buying?

Plan for $315k–$370k total liquidity on a $1M purchase: $240k–$255k upfront + $60k–$90k emergency fund + $15k–$25k improvements.

Is Lake Lanier waterfront a good investment?

Historic ~5.6% annual appreciation, Corps-limited supply, and potential STR income ($35k–$100k/yr) support strong long-term returns for 5+ year horizons.

What are typical monthly costs?

Owners: ~$6,935–$7,847/mo (plus waterfront extras). Renters: ~$6,450–$15,700/mo. Ownership builds equity; renting does not.

Break-even holding period?

Typically 4–5 years after closing costs and expected appreciation. Under 5 years, consider renting.

Can I do Airbnb/short-term rentals?

Rules vary by county/HOA. Verify permits, zoning, and restrictions in Forsyth, Hall, Dawson, Gwinnett, and Cherokee before purchase.

Do I need flood insurance?

Most waterfront homes with mortgages require flood coverage (FEMA zones). Costs range widely—obtain an elevation certificate during inspections.

Property taxes on a $500k home?

Approx. $3,400–$5,900 depending on county. Homestead and senior exemptions can reduce taxes.

Conclusion: Making Your Decision

For qualified buyers planning 5+ years, ownership typically outperforms renting—despite higher upfront cash—thanks to appreciation and principal paydown. If you’re testing the lifestyle or lack liquidity, rent first while we watch inventory and timing.

- Choose Ownership: Income $150k+, $200k+ down, 5+ year horizon, wealth/legacy goals.

- Choose Renting: < 3–5 years horizon, limited capital, job mobility, trial period.

Explore: Lake Lanier luxury guide · new vs existing homes · year-round activities · boating lifestyle · Buford cost of living · nearby grocery stores

Categories

Recent Posts