Lake Lanier Vacation Rental Investment Guide 2025 | ROI, Regulations & Reality

Quick Answer: Lake Lanier vacation rentals generate $24,000-$85,000 annual revenue but typically produce negative cash flow (-$13,000 to -$36,000 annually) when financed due to high property costs and 7.25-7.5% investment rates. Total returns including 4% appreciation range 2.7%-6.5%. Lakefront properties with private docks perform best (6.5% total return). Regulatory complexity varies: Forsyth County highly restrictive (agricultural zoning only), Hall County permissive. Best as long-term wealth building with tax benefits, not high-yield cash flow investment. Cash purchases or 40%+ down payment required for positive cash flow.

About the Author: Beka Rickman

Beka Rickman is a Lake Lanier real estate agent with Beka & Associates Real Estate (GA License ID 361599). She lives the lake lifestyle and helps investors understand the complete financial reality of vacation rental investment—including the parts most "gurus" won't tell you about negative cash flow and regulatory complexity. See Beka's full bio.

Contact: 404-606-3905 • beka@bekasells.com • Schedule a consult

4335 South Lee St, Suite D, Buford, GA 30518

I need to be direct with you: If you're considering Lake Lanier vacation rental investment because you've seen those "make $100K+ annually!" videos on YouTube, stop right now and read this entire guide.

After helping many clients analyze Lake Lanier investment opportunities, I've learned that most people have completely unrealistic expectations about vacation rental returns. They see gross revenue numbers and assume that's profit. They ignore the brutal reality of operating costs, mortgage payments, and regulatory headaches.

Here's what nobody tells you: Most financed Lake Lanier vacation rentals lose money every month. The properties that succeed do so through long-term appreciation, tax benefits, and personal use enjoyment—not monthly cash flow.

Disclaimer: Tax advice should be verified with qualified CPAs

But that doesn't mean vacation rental investment is a bad idea. It just means you need to understand the complete picture before buying. In this guide, I'm sharing the honest financial reality, regulatory challenges, and strategic approaches that actually work in 2025.

The Lake Lanier Vacation Rental Market: Current Reality

Before diving into financials, understand the market you're entering.

Market Strength Indicators:

- Lake Lanier attracts 11+ million visitors annually

- 36% surge in real estate sales (2024)

- Luxury properties ($1M+) represent 47% of sales

- Average occupancy rates: 61% (successful properties: 70%+)

- Strong tourism demand year-round

Property Performance by Type:

Lakefront with Private Dock:

- Average daily rate: $275

- Occupancy: 65%

- Annual gross revenue: ~$65,000

- Highest performer in all metrics

Lake Access Community (Shared Dock):

- Average daily rate: $190

- Occupancy: 62%

- Annual gross revenue: ~$43,000

- Middle performer

Near-Lake (No Water Access):

- Average daily rate: $140

- Occupancy: 58%

- Annual gross revenue: ~$30,000

- Lowest performer

Learn more about specifics by zip code

Key Insight: Water access drives premium pricing. Understanding dock access is critical to investment success.

Considering Lake Lanier vacation rental investment? Schedule a financial reality check consultation and I'll show you actual numbers—not marketing hype—for properties matching your budget.

The Financial Reality: Complete Cost Breakdown

Let me walk you through what vacation rental ownership actually costs, because this is where most investors' dreams meet reality.

Revenue Reality

Gross Revenue Potential:

For a typical $800K lakefront property with private dock:

- Daily rate: $250-300

- Target occupancy: 65% (237 nights)

- Annual gross revenue: $59,000-$71,000

But gross revenue means nothing. Here's what you'll actually net:

Operating Expenses (The Money Pit)

Property Management (10-15% of gross):

- Professional management: $5,900-$10,650 annually

- Self-management saves money but requires 20+ hours weekly

- You need professional management for success

Platform Fees (3% of gross):

- Airbnb/VRBO commissions: $1,770-$2,130 annually

- Non-negotiable if you want bookings

Cleaning (8-10% of gross):

- Per-turnover cleaning: $4,720-$7,100 annually

- Must be exceptional or reviews suffer

- Cannot compromise on cleanliness

Insurance ($2,200-$3,500 annually):

- Short-term rental insurance significantly higher than standard

- Liability coverage essential

- Minimum $1M liability recommended

Property Taxes ($6,400-$11,200 annually):

- Forsyth County (1.18%): $9,440 on $800K

- Hall County (1.09%): $8,720 on $800K

- Dawson County (0.68%): $5,440 on $800K

- County selection impacts annual costs by $4,000+

Utilities ($2,000-$4,200 annually):

- Higher usage with guests

- Must maintain climate control year-round

- Internet/cable essential amenities

Maintenance & Repairs (6-8% of revenue):

- Annual: $3,540-$5,680

- HVAC, plumbing, appliances wear faster

- Dock maintenance: Additional $2,000-$5,000

Supplies & Amenities ($1,500-$3,000 annually):

- Linens, toiletries, kitchen supplies

- Replacement furniture and decor

- Guest amenities (lake toys, etc.)

Business License & Permits ($50-$500 annually):

- County-specific requirements

- Annual renewal fees

- Conditional use permits (if required)

Total Operating Expenses: $28,000-$48,000 annually

The Mortgage Reality Check

This is where most investors' plans collapse.

Investment Property Financing:

- Current rates: 7.25-7.5% (significantly higher than primary residence)

- Minimum 20% down payment required

- Some lenders require 25-30% down

Example: $800K Property

- Down payment (20%): $160,000

- Loan amount: $640,000

- Rate: 7.5%

- Monthly payment (P&I): $4,473

- Annual debt service: $53,676

The Math:

- Gross revenue: $65,000

- Operating expenses: -$38,000

- Net operating income: $27,000

- Debt service: -$53,676

- Annual cash flow: -$26,676

You're losing $2,223 per month.

This is the reality most "gurus" don't show you.

When Vacation Rentals Actually Work

Cash Purchase Scenario:

- Gross revenue: $65,000

- Operating expenses: -$38,000

- Net cash flow: +$27,000 annually

- Cash-on-cash return: 3.4% on $800K investment

- Plus 4% appreciation: 7.4% total return

High Down Payment Scenario (50% down):

- Down payment: $400,000

- Loan amount: $400,000

- Annual debt service: $33,548

- Gross revenue: $65,000

- Operating expenses: -$38,000

- Net operating income: $27,000

- Debt service: -$33,548

- Annual cash flow: -$6,548 (much better but still negative)

Break-Even Analysis:

To achieve positive cash flow with financing:

- Need 40-50% down payment minimum

- Require 70%+ occupancy consistently

- Must achieve $275+ daily rates

- Operating expenses must stay under 60% of revenue

Reality: Only 15-20% of financed Lake Lanier vacation rentals achieve positive cash flow.

Total Return Perspective: Why Investors Still Buy

If cash flow is negative, why do sophisticated investors still buy Lake Lanier vacation rentals?

Total Return Components:

1. Property Appreciation (4% annually):

- $800K property appreciates $32,000 annually

- Over 5 years: $160,000 gain

- Over 10 years: $352,000 gain

2. Mortgage Pay-Down:

- Principal reduction: $10,000-$15,000 annually

- Building equity while tenants pay mortgage

3. Tax Benefits (Substantial for Qualifying Investors):

- Short-term rental tax loophole (average stays under 7 days)

- Deduct losses against other income if 100+ hours annually involved

- Depreciation deductions (~$29,000 annually on $800K property)

- Section 179 elections for furnishings and improvements

4. Personal Use Value:

- Use property 2-4 weeks annually

- Replace vacation rental costs ($5,000-$10,000 value)

- Build family memories while investing

Total Return Calculation ($800K Property, 50% Down):

Annual:

- Cash flow: -$6,548

- Appreciation: +$32,000

- Mortgage pay-down: +$12,000

- Tax benefit (if qualifying): +$10,000-$15,000

- Total annual return: $47,452-$52,452

- ROI: 11.9-13.1% on $400K investment

This is how vacation rental investment actually works—it's a long-term wealth building strategy, not a monthly cash flow bonanza.

Want to run the numbers on a specific Lake Lanier property? Book an investment analysis consultation and I'll create a detailed financial model showing your actual expected returns.

Regulatory Landscape: County-by-County Requirements

Regulatory compliance can make or break your investment. Lake Lanier spans multiple counties with vastly different rules.

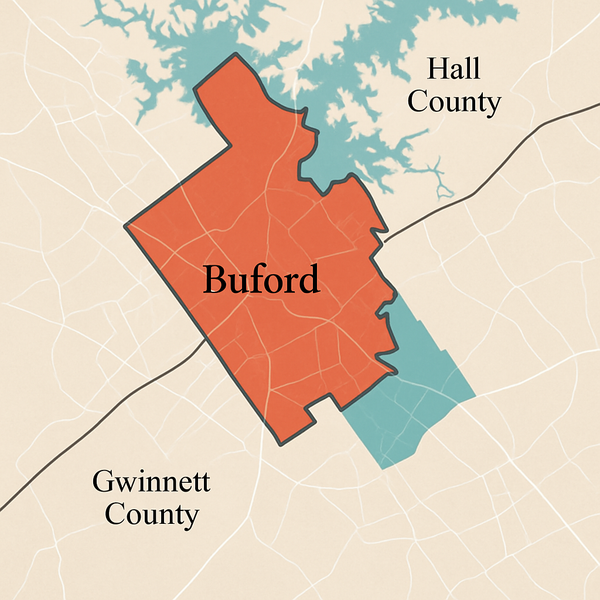

Forsyth County: Most Restrictive

Zoning Limitations:

- Short-term rentals ONLY in Agricultural (A1) or Ag-Res zoning

- Eliminates 95%+ of lakefront properties

- Properties in residential zoning cannot operate as short-term rentals

Permit Requirements:

- Conditional use permit required

- Annual license: $250

- Local contact person within 3 hours response time

- 24/7 availability mandatory

Occupancy Restrictions:

- 2 guests per bedroom + 3 additional maximum

- Strictly enforced

- Violations result in permit revocation

Legal Challenges:

- Multiple lawsuits filed against county (ongoing)

- Regulations may change

- High compliance risk

Investment Implication: Forsyth County properties are extremely risky for vacation rental investment unless properly zoned.

Hall County: Most Permissive

Zoning Allowance:

- Short-term rentals permitted in all residential zoning districts

- Much larger property pool available

- Lower regulatory barrier

Permit Requirements:

- Business license: $25-50 annually

- Occupancy limits: 2 per bedroom + 3 additional max

- Safety code compliance required

Tax Requirements:

- State sales tax: 4%

- County tax: 2-5%

- Hotel-motel fee: $5 per night (stays under 30 days)

Investment Implication: Hall County offers best regulatory environment for Lake Lanier vacation rentals.

Gwinnett County: Under Review

Current Status:

- Conditional use allows short-term rentals

- Regulations under review for 2025

- Future restrictions possible

Investment Implication: Gwinnett carries regulatory uncertainty risk.

Compliance Essentials (All Counties)

Business Licensing:

- Mandatory in all counties

- Annual renewal required

- Penalties for operating without license

Tax Registration:

- Must collect and remit all applicable taxes

- Quarterly or monthly filing

- Significant penalties for non-compliance

Safety Standards:

- Proper egress from all bedrooms

- Smoke detectors and carbon monoxide alarms

- Life safety code compliance

- Fire extinguishers required

Local Contact Requirements:

- 24/7 availability

- 3-hour response time (most jurisdictions)

- Contact information provided to county

My Strong Recommendation: Verify zoning and regulatory compliance BEFORE purchasing. I've seen investors buy properties they cannot legally operate as vacation rentals, losing hundreds of thousands.

Investment Strategies That Actually Work

After analyzing many potential vacation rental investments, here are strategies with proven success:

Strategy 1: Cash Purchase Focus

Best for: High net worth investors, 1031 exchange buyers, cash-rich investors

Advantages:

- Immediate positive cash flow

- No mortgage interest expense

- Flexibility in occupancy strategies

- Lower financial stress

Returns:

- Cash-on-cash: 3-4% from operations

- Total return: 7-8% including appreciation

- Tax benefits add 1-2% effective return

Property Targets:

- $600K-$1M lakefront with private dock

- Hall County for regulatory ease

- Properties with established rental history

Strategy 2: High Down Payment + Tax Strategy

Best for: High-income professionals, business owners, active investors

Requirements:

- 40-50% down payment

- 100+ hours annual involvement (for tax benefits)

- CPA familiar with short-term rental tax strategies

Tax Benefit Mechanics:

- Average stays under 7 days = "non-rental" for tax purposes

- Can deduct losses against other income

- Depreciation offsets positive cash flow from other sources

- Section 179 immediate deduction for improvements

Returns:

- Cash flow: -$5,000 to break-even

- Tax benefit: $10,000-$20,000 annually

- Appreciation: $32,000 (4% on $800K)

- Effective total return: 9-12%

Strategy 3: Luxury Property Premium Positioning

Best for: Investors targeting high-net-worth guests

Property Criteria:

- $1.5M+ purchase price

- Private dock with boat lift

- Premium finishes and amenities

- 4+ bedrooms, 4,000+ sq ft

Pricing Power:

- $400-$600 daily rates achievable

- Less price-sensitive guests

- Lower vacancy during off-season

- Corporate retreats and events

Returns:

- Higher gross revenue: $80,000-$120,000

- Operating expenses: 50-55% of revenue

- Better chance of positive cash flow even with financing

- Strong appreciation in luxury segment

Strategy 4: Personal Use + Rental Income

Best for: Families wanting lake access with investment benefits

Approach:

- Purchase property for personal use

- Rent when not using (20-40 weeks annually)

- Cover ownership costs with rental income

- Enjoy lake lifestyle while building equity

Financial Structure:

- Not focused on positive cash flow

- Rental income offsets ownership costs

- Appreciation builds long-term wealth

- Personal use has significant lifestyle value

Tax Implications:

- Personal use limits (14 days or 10% of rental days)

- Deduction limitations if personal use excessive

- Still depreciate property

- Still deduct operating expenses proportionally

Risk Mitigation and Success Factors

Critical Success Factors

1. Professional Management (Non-Negotiable):

DIY management seems cheaper but typically costs more through:

- Lower occupancy rates (amateur marketing)

- Guest issues and negative reviews

- Maintenance emergencies mishandled

- Regulatory compliance gaps

Professional management delivers:

- 10-15% higher occupancy through expert marketing

- 4.8+ star ratings consistently

- 24/7 emergency response

- Regulatory compliance assurance

- Worth the 10-12% management fee

2. Property Selection Excellence:

Winning characteristics:

- Private dock (commands $50-$100 higher daily rates)

- 4+ bedrooms (higher revenue per property)

- Updated interiors (better reviews, higher rates)

- Game rooms or unique amenities

- Good water access during low water

Losing characteristics:

- Dated interiors (lower rates, harder to rent)

- No water access (30-40% lower revenue potential)

- Difficult site access

- Regulatory compliance issues

3. Conservative Financial Planning:

Plan for worst-case:

- 50% occupancy in financial models (not 65%)

- 10% higher operating costs than projected

- Unexpected repairs ($5,000-$10,000 annually)

- Rate compression during economic downturns

Build reserves:

- 6 months operating expenses in reserve

- $20,000-$30,000 maintenance fund

- Capital improvements budget

4. Regulatory Compliance Vigilance:

Maintain perfect compliance:

- Business licenses current

- All taxes collected and remitted

- Safety inspections up to date

- Insurance coverage adequate

- Local contact responsive

One violation can:

- Trigger permit revocation

- Result in $500-$5,000 fines

- Create legal liability

- Damage long-term investment value

Common Mistakes to Avoid

Mistake 1: Assuming Gross Revenue = Profit

- Operating expenses consume 50-60% of revenue

- Mortgage payments often exceed net operating income

- Reality check: Run complete financial models

Mistake 2: Ignoring Regulatory Compliance

- Buying in Forsyth County without proper zoning

- Operating without required licenses

- Failing to collect/remit taxes

- Result: Forced closure, financial losses

Mistake 3: Undercapitalizing

- Minimal down payment (20%) on investment property

- No cash reserves for vacancies or repairs

- Assuming immediate high occupancy

- Result: Monthly cash flow stress, forced sale

Mistake 4: Poor Property Selection

- Buying cheapest available property

- Ignoring water access importance

- Accepting properties with deferred maintenance

- Result: Low rates, high expenses, negative reviews

Mistake 5: DIY Management

- Underestimating time commitment (20+ hours weekly)

- Amateur marketing reducing occupancy

- Guest issue mismanagement creating bad reviews

- Result: Lost revenue exceeding management cost savings

Lake Lanier Vacation Rental Investment: My Honest Recommendation

After helping many investor clients evaluate vacation rental opportunities, here's my straightforward advice:

Lake Lanier vacation rentals CAN be excellent investments IF:

✓ You have 40-50% down payment available ✓ You understand cash flow will likely be negative or neutral ✓ You're investing for 7-10+ year time horizon ✓ You qualify for short-term rental tax benefits ✓ You'll use the property personally 2-4 weeks annually ✓ You're comfortable with regulatory complexity ✓ You hire professional management ✓ You select property in Hall County or proper Forsyth zoning

Lake Lanier vacation rentals are POOR investments IF:

✗ You need positive monthly cash flow immediately ✗ You're maximizing leverage (20% down) ✗ You're seeking short-term flip opportunity ✗ You can't qualify for tax benefits ✗ You won't use property personally ✗ You're trying to DIY management ✗ You're buying in wrong Forsyth County zoning

The Bottom Line:

Lake Lanier vacation rental investment works best as a long-term wealth building strategy combining:

- Modest operational results (break-even to small negative)

- Strong property appreciation (4% annually)

- Substantial tax benefits (for qualifying investors)

- Personal use value ($5,000-$10,000 annually)

- Long-term equity building

Total effective returns of 8-12% are realistic for well-structured investments. But anyone promising 15-20% cash-on-cash returns is either lying or taking extraordinary risks.

Your Next Steps: Making an Informed Investment Decision

Don't make a $800K-$1.5M investment based on YouTube videos and Airbnb calculator estimates. Here's how I help clients make smart Lake Lanier vacation rental investments:

My Investment Analysis Process:

✓ Property-specific financial modeling - Detailed projections based on actual market data ✓ Regulatory compliance verification - Ensuring property can legally operate

✓ Competitive analysis - Understanding local rental market dynamics ✓ Tax strategy consultation - Connecting you with STR-specialized CPAs ✓ Property manager recommendations - Introducing proven local operators ✓ Exit strategy planning - Understanding long-term value and resale potential

I'll show you:

- Actual cash flow projections (not optimistic marketing)

- Complete operating cost breakdown

- County regulatory requirements and risks

- Tax benefit opportunities (and qualifications)

- Property selection criteria for best performance

- Management company options and costs

Whether you decide Lake Lanier vacation rental investment is right for you or not, you'll have complete clarity on the financial reality.

Schedule Your Lake Lanier Vacation Rental Investment Analysis

In this consultation, I'll review your specific financial situation, investment goals, and risk tolerance—then show you whether Lake Lanier vacation rental investment makes sense for YOU (not someone else's situation).

Frequently Asked Questions

Is Lake Lanier vacation rental investment profitable?

Lake Lanier vacation rentals generate $24,000-$85,000 annual gross revenue but typically produce negative cash flow (-$13,000 to -$36,000 annually) when financed with traditional investment mortgages at 7.25-7.5% interest rates. Total returns including 4% property appreciation range 2.7%-6.5% annually. Lakefront properties with private docks perform best at 6.5% total return. Profitability improves dramatically with cash purchase (3-4% cash-on-cash return) or 40-50% down payment. Short-term rental tax benefits can add 2-4% effective return for qualifying investors spending 100+ hours annually in the business. Best viewed as long-term wealth building strategy, not cash flow investment.

What are Lake Lanier vacation rental regulations by county?

Forsyth County is most restrictive: short-term rentals only permitted in Agricultural (A1) or Ag-Res zoning (eliminates 95%+ of lakefront properties), requires conditional use permit and $250 annual license, mandates 24/7 local contact within 3 hours. Hall County is most permissive: allows short-term rentals in all residential zoning districts, requires $25-50 business license, standard occupancy limits apply. Gwinnett County currently allows under conditional use but regulations under review for 2025. All counties require business licensing, tax collection/remittance (state 4% + county 2-5% + $5/night hotel-motel fee), and safety code compliance. Verify zoning compliance before purchasing—many properties cannot legally operate as vacation rentals.

How much can I make renting my Lake Lanier home on Airbnb?

Lake Lanier Airbnb revenue varies dramatically by property type: Lakefront with private dock averages $275/night at 65% occupancy = $65,000 annual gross, Lake access community (shared dock) averages $190/night at 62% occupancy = $43,000 annual gross, Near-lake without water access averages $140/night at 58% occupancy = $30,000 annual gross. However, operating expenses consume 50-60% of revenue: property management 10-15%, platform fees 3%, cleaning 8-10%, insurance $2,200-$3,500, property taxes $4,000-$12,000 (county dependent), utilities $2,000-$4,200, maintenance 6-8%, supplies $1,500-$3,000. Net operating income typically $20,000-$35,000 before mortgage payments. Financed properties usually show negative cash flow due to high debt service.

What down payment do I need for Lake Lanier vacation rental property?

Investment property mortgages require minimum 20% down payment, though many lenders require 25-30% for vacation rentals due to higher risk profile. However, achieving positive cash flow requires 40-50% down payment minimum due to high debt service costs at 7.25-7.5% interest rates. Example: $800K property with 20% down ($160,000) has annual debt service of $53,676, typically exceeding net operating income and creating negative cash flow. With 50% down ($400,000), annual debt service drops to $33,548, approaching break-even. Cash purchases eliminate debt service and generate 3-4% cash-on-cash returns plus 4% appreciation. Financial institutions view vacation rentals as higher risk than traditional investment properties, resulting in stricter lending requirements.

Can I use Lake Lanier vacation rental losses to offset my income?

Yes, if your Lake Lanier vacation rental qualifies as a short-term rental with average guest stays under 7 days AND you spend 100+ hours annually materially participating in the business. The "short-term rental tax loophole" allows you to deduct vacation rental losses against other income (W-2, business income, etc.) without passive activity loss limitations that restrict traditional rental properties. Additionally: depreciation deductions (~$29,000 annually on $800K property) offset income even with positive cash flow, Section 179 elections allow immediate deduction of furnishings and improvements up to $1,160,000, operating expenses fully deductible (management fees, supplies, repairs, insurance, taxes, utilities). This can create $15,000-$25,000 annual tax benefit for high-income earners. Consult CPA specializing in short-term rentals before purchasing to verify qualification and maximize benefits.

Which Lake Lanier county is best for vacation rental investment?

Hall County offers the best regulatory environment for Lake Lanier vacation rental investment: permits short-term rentals in all residential zoning districts (largest property pool), simple business licensing ($25-50 annually), reasonable occupancy limits (2 per bedroom + 3 max), no conditional use permit required, and established regulatory framework (lower uncertainty). Forsyth County is most restrictive and risky: only Agricultural/Ag-Res zoning permitted (eliminates 95%+ properties), requires conditional use permit, faces ongoing legal challenges, $250 annual license, strictly enforced regulations. Gwinnett County carries uncertainty with regulations under 2025 review. For property taxes, Dawson County offers lowest rates (0.68% vs. Forsyth 1.18%), saving $4,000+ annually on $800K property. Overall recommendation: Hall County for regulatory ease plus property selection in lower-tax areas if possible.

How does Lake Lanier vacation rental cash flow compare to traditional rental?

Lake Lanier vacation rentals generate significantly higher gross revenue than traditional long-term rentals but also have much higher operating expenses. Traditional rental on $800K property: $3,000-$3,500/month rent = $36,000-$42,000 annual income, operating expenses 25-35% of revenue, net operating income $23,400-$31,500 before debt service, typically positive cash flow with standard financing. Vacation rental same property: $43,000-$65,000 annual gross revenue (depending on water access), operating expenses 50-60% of revenue, net operating income $20,000-$35,000 before debt service, typically negative cash flow when financed. However, vacation rentals offer tax advantages traditional rentals cannot: short-term rental tax loophole allowing loss deductions against other income, higher depreciation benefits, Section 179 elections. Best strategy often depends on investor's tax situation and involvement level.

What are the biggest risks of Lake Lanier vacation rental investment?

Major Lake Lanier vacation rental risks include: Regulatory changes (Forsyth County already restricted, other counties may follow—properties could lose rental rights worth $40,000-$65,000 annually), negative cash flow stress (typical -$13,000 to -$36,000 annually when financed straining finances), occupancy volatility (61% average but individual properties vary 40-80%—lower occupancy devastating), property damage from guests (insurance may not cover all losses, deductibles apply), market saturation (increasing vacation rental supply compressing rates), economic downturn impact (luxury travel discretionary—recessions reduce demand 30-50%), maintenance cost surprises (HVAC, dock repairs, septic issues $10,000-$30,000 unexpected), and financing challenges (investment property rates higher, refinancing difficult if property doesn't appraise). Mitigation requires substantial cash reserves, proper insurance, professional management, regulatory compliance vigilance, and conservative financial planning assuming worst-case scenarios.

Should I self-manage or hire professional management for Lake Lanier rental?

Hire professional management for Lake Lanier vacation rentals—DIY management appears cheaper but typically costs more through lower occupancy and guest issues. Professional management (10-12% of revenue) delivers: 10-15% higher occupancy through expert marketing across multiple platforms, consistent 4.8+ star ratings (essential for bookings), 24/7 emergency response (guests expect immediate attention), regulatory compliance assurance (avoiding $500-$5,000 fines), optimized pricing strategies (dynamic pricing increases revenue 15-20%), and professional photography and listing optimization. DIY management requires 20+ hours weekly, amateur marketing reduces occupancy, guest issue mismanagement creates negative reviews (severely damaging future bookings), and compliance gaps risk permit revocation. Reality: Properties with professional management typically gross $8,000-$12,000 more annually (15-20% higher) than DIY despite management fee, netting $5,000-$7,000 additional income after fee deducted. Professional management worth investment for all but most hands-on owners.

What Lake Lanier property features maximize vacation rental income?

Highest-performing Lake Lanier vacation rental features include: Private dock with boat access (adds $50-$100 daily rate premium over no access, commands $275 vs. $140-$190), 4+ bedrooms (larger groups pay significantly more—$100-$150/night premium over 3 bedrooms), game rooms or unique entertainment (pool tables, arcades add $30-$50 daily premium), outdoor living spaces (fire pits, outdoor kitchens, large decks increase booking rates 20-30%), luxury finishes and modern updates (granite, stainless appliances, contemporary decor supports premium pricing), hot tubs or pools (nearly essential—properties without discount 15-20%), and main channel deep-water locations (maintain water access during drawdowns, premium positioning). Avoid: Dated interiors (force 25-35% rate discounts), no water access (30-40% revenue reduction), difficult site access (limits guest pool), shared dock only (reduces privacy appeal), and small lots with limited outdoor space (families prefer room for activities). Focus investment on water access and bedroom count for maximum revenue.

Categories

Recent Posts