Buford GA Cost of Living 2025 | Housing, Taxes & Lake Lanier Expenses Guide

Last updated: October 7, 2025

Buford, GA has a cost of living index of 106, approximately 6% above the national average and 14% higher than Georgia's state average. Housing drives this premium, with median home values around $474,000 city-wide and waterfront Lake Lanier properties ranging from $500,000 to over $4 million. Additional lakefront ownership costs—including property taxes, insurance, and dock maintenance—add $15,000–$40,000 annually beyond mortgage payments.

How Much Does It Cost to Live in Buford, Georgia?

Buford's cost of living reflects its desirable location near Lake Lanier and proximity to Atlanta. Housing expenses dominate the budget, particularly for buyers seeking waterfront access or luxury properties. Understanding the complete financial picture requires examining not just purchase prices but ongoing costs unique to this lakefront community.

Cost of Living Index Breakdown

The overall cost of living index of 106 places Buford above both national and state benchmarks. Key categories break down as follows:

- Housing: Significantly above national average of 100 (primary cost driver)

- Healthcare: 109 index (9% above national average of 100)

- Groceries: 100-101 index (on par with national average of 100)

- Transportation: 96-99 index (1-4% below national average of 100)

- Utilities: 81 index (19% below national average of 100)

- Goods & Services: 98-100 index (near national average of 100)

Residents benefit from lower utility costs, but housing expenses—especially for Lake Lanier waterfront properties—quickly offset these savings.

Buford GA Housing Costs: What to Expect in 2025

Non-Waterfront Housing Market

Standard Buford residential properties show considerable variation based on location and property type:

Home Values:

- City-wide median home value: $474,000

- Downtown Buford median: $639,000

- Typical range: $424,000–$640,000+

Rental Market:

- Studio apartments: $1,002–$1,200/month

- One-bedroom units: $1,497–$1,874/month

- Two-bedroom units: $1,700–$2,000/month

- Three-bedroom units: $2,000–$2,168+/month

Downtown Buford commands premium prices due to historic charm, walkability, and proximity to dining and entertainment. Neighborhoods farther from the lake and downtown core offer more affordable options while maintaining access to quality schools and amenities.

Ready to explore Buford homes that fit your budget? Schedule a consultation to discuss current inventory and pricing strategies.

Lake Lanier Waterfront Property Costs

Lake Lanier real estate operates in a distinct premium market segment. Waterfront access creates pricing tiers that reflect property condition, location, and amenities:

Purchase Price Ranges:

- Entry-level waterfront homes: $500,000–$800,000

- Updated waterfront properties: $800,000–$1.5 million

- Luxury waterfront estates: $1.5 million–$4 million+

- Non-waterfront homes in lake communities: $338,000 median

Location matters significantly. Properties in quiet coves near Paradise Point or Hideaway Bay Marina command different prices than homes on busy lake sections. Deep water access, dock permits, and protected locations influence value substantially.

Buyers considering Lake Lanier luxury properties should budget for both purchase price and substantial annual ownership costs detailed below.

Hidden Costs of Lake Lanier Living

Waterfront property ownership involves expenses beyond traditional homeownership. These recurring costs significantly impact affordability:

Annual Ownership Expenses

Property Taxes (varies by county):

- Dawson County: $3,400–$5,000 (lowest rates)

- Forsyth County: $8,000–$11,800 (highest rates)

- Hall County: $4,500–$7,500 (mid-range)

Understanding Lake Lanier property taxes by county helps buyers identify potential savings through strategic location selection.

Insurance Costs:

- Homeowners insurance: $2,500–$5,000/year (higher for waterfront)

- Flood insurance: $1,000–$3,000/year (often required)

- Umbrella liability: $500–$1,500/year (recommended)

Dock and Waterfront Maintenance:

- Annual dock maintenance: $2,000–$5,000

- Seawall repairs: Variable, potentially $10,000+ for major work

- Erosion control: $1,000–$3,000/year

- Landscaping (waterfront): $3,000–$6,000/year

HOA and Community Fees:

- Typical range: $500–$2,500/year

- Amenity-rich communities: $3,000–$5,000+/year

- Gated communities: Premium fees for security and maintenance

Boat Ownership and Recreation Costs

Lake life naturally includes watercraft expenses:

- Boat purchase: $20,000–$100,000+ (one-time)

- Boat insurance: $500–$2,000/year

- Fuel costs: $1,500–$4,000/year (moderate use)

- Maintenance and winterization: $1,000–$3,000/year

- Storage (if not docked at home): $1,200–$3,600/year

- Boat club membership (alternative): $3,000–$6,000/year

Total additional annual costs for Lake Lanier waterfront living typically range from $15,000–$40,000 beyond mortgage payments. This places recommended household income at $150,000–$200,000 for comfortable lakefront ownership.

Schedule a Lake Lanier property tour to see firsthand how location affects both purchase price and ongoing costs.

Comparing Lake Lanier vs Buford vs Metro Atlanta Costs

Understanding relative affordability requires comparing multiple market segments:

| Market Segment | Median Home Price | Average Rent | Key Considerations |

|---|---|---|---|

| Lake Lanier Waterfront | $500,000–$4M+ | $6,000–$15,000 (luxury) | Premium for water access; high annual costs |

| Lake Lanier Non-Waterfront | $338,000–$455,000 | $1,517/month | Lake community benefits without waterfront costs |

| Buford City-Wide | $424,000–$640,000+ | $1,497–$1,874 | Mix of suburban and luxury properties |

| Downtown Buford | $639,000 | $1,400–$2,800 | Historic charm; walkability premium |

| Metro Atlanta | ~$400,000 | $1,500+ | Urban amenities; longer commutes |

| Dahlonega | ~$300,000 | ~$1,000 | Most affordable nearby option; mountain setting |

Buyers seeking lake access without waterfront premiums often choose non-waterfront homes in lake communities. These properties offer community amenities, lake access, and proximity to marinas while significantly reducing ownership costs.

Those comparing new construction versus existing homes on Lake Lanier should factor in customization benefits against potentially higher purchase prices.

Grocery, Healthcare, and Daily Living Expenses

Beyond housing, everyday costs in Buford remain manageable:

Grocery Costs

Buford grocery prices align closely with national averages, with the index at 100-101 compared to the national baseline of 100:

- Loaf of bread: $3.97 (national average: ~$3.50)

- Gallon of milk: $4.72 (national average: ~$4.50)

- Dozen eggs: $3.50–$4.50 (national average: ~$3.75)

- Pound of chicken breast: $4.50–$6.00 (national average: ~$5.00)

- Monthly grocery bill (family of 4): $800–$1,200

Major grocery chains including Publix, Kroger, Walmart, and Aldi provide competitive pricing. Proximity to multiple options keeps costs in check.

Healthcare Expenses

Healthcare costs run approximately 9% above national averages, with Buford's healthcare index at 109 compared to the national baseline of 100:

- General practitioner visit: $147 in Buford (national average: $100)

- Dentist visit: $120 in Buford (national average: $110)

- Optometrist exam: $133 in Buford (national average: $120)

- Prescription medications: Close to national average

Buford benefits from proximity to multiple hospital systems including Northside Hospital and Northeast Georgia Medical Center, providing quality care with competitive pricing.

Transportation Costs

Transportation expenses remain close to national averages, with Buford's index at 96-99 compared to the national baseline of 100:

- Gasoline: $3.12/gallon in Buford (national average: ~$3.25/gallon)

- Car insurance: $1,400–$1,800/year (Georgia average; national average: ~$1,600/year)

- Vehicle registration: $20 base fee plus ad valorem tax

- Typical monthly transportation: $500–$700 (car payment, insurance, fuel)

Most residents rely on personal vehicles given limited public transportation. Commuters to Atlanta face 45–60 minute drives, adding fuel and maintenance costs. However, living near Lake Lanier provides recreational benefits that offset commuting trade-offs for many families.

Utilities and Services: A Bright Spot

Utility costs in Buford run 19% below national averages, with an index of 81 compared to the national baseline of 100. This provides meaningful monthly savings:

Monthly Utility Breakdown

- Electricity: $173/month in Buford (national average: $207/month)

- Water and sewer: $60–$90/month

- Natural gas: $40–$80/month (seasonal variation)

- Internet and cable: $100–$150/month

- Cell phone: $163/month in Buford (household plan; national average: ~$150/month)

Total monthly utilities: $536–$663 in Buford (vs. $700+ nationally)

Lower electricity costs stem from competitive Georgia energy markets and relatively mild climate. Summer cooling and winter heating demands remain moderate compared to extreme climate regions.

Property Taxes: County-by-County Comparison

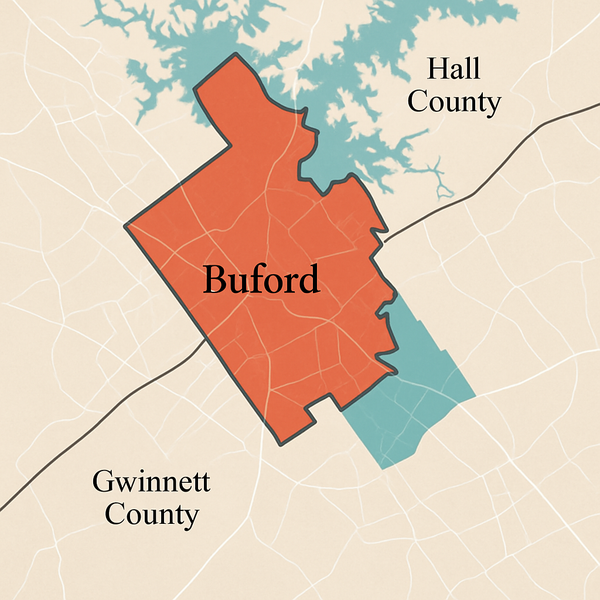

Property tax rates vary significantly across Lake Lanier counties, creating strategic opportunities for buyers:

Lake Lanier Tax Rate Comparison

| County | Millage Rate | Example Tax ($500K Home) | Notes |

|---|---|---|---|

| Dawson | ~17 mills | $3,400 | Lowest rates; smaller county |

| Hall | ~23 mills | $4,600 | Mid-range; largest lake frontage |

| Forsyth | ~35 mills | $7,000 | Highest rates; excellent schools |

| Gwinnett | ~31 mills | $6,200 | High services; good schools |

Choosing a home just across county lines can save $2,000–$4,000 annually in property taxes. Buyers should weigh tax savings against school quality, services, and commute times.

Detailed property tax analysis by Lake Lanier county helps buyers optimize location selection for long-term savings.

Income Requirements for Comfortable Living

Financial professionals recommend housing costs not exceed 28% of gross monthly income. For Buford and Lake Lanier, recommended income levels break down as follows:

Non-Waterfront Buford Homes

$424,000 home purchase:

- Monthly mortgage payment: ~$2,900 (including taxes, insurance)

- Recommended annual income: $124,000

- Monthly take-home needed: $10,000+

$639,000 home purchase (Downtown Buford):

- Monthly mortgage payment: ~$4,400

- Recommended annual income: $188,000

- Monthly take-home needed: $15,000+

Lake Lanier Waterfront Properties

$570,000 waterfront home:

- Monthly mortgage payment: ~$3,900

- Additional annual costs: $15,000–$25,000 ($1,250–$2,083/month)

- Total monthly housing cost: $5,150–$5,983

- Recommended annual income: $150,000–$175,000

$1.2 million waterfront home:

- Monthly mortgage payment: ~$8,200

- Additional annual costs: $25,000–$40,000 ($2,083–$3,333/month)

- Total monthly housing cost: $10,283–$11,533

- Recommended annual income: $300,000+

These calculations assume 20% down payments and include property taxes, insurance, and lake-specific expenses. Understanding the complete cost to live on Lake Lanier prevents financial strain from unexpected expenses.

Investment Property Considerations

Lake Lanier's tourism appeal creates vacation rental opportunities, though profitability requires careful analysis:

Vacation Rental Income Potential

Peak season (May–September):

- Luxury lakefront home: $500–$800/night

- Standard lakefront home: $300–$500/night

- Non-waterfront lake community: $150–$300/night

Off-season (October–April):

- Rates typically 30–50% lower

- Occupancy drops significantly

Annual Gross Income Potential:

- Well-managed luxury property: $60,000–$100,000

- Standard waterfront property: $35,000–$60,000

- After expenses (40–50% typically): Net 50–60% of gross

Investors must account for management fees (20–30%), cleaning, maintenance, HOA restrictions, and property taxes. Lake Lanier vacation rental investment analysis provides detailed ROI projections and regulatory considerations.

Discuss investment property potential on Lake Lanier with a specialist who understands rental market dynamics and regulations.

Cost-Saving Strategies for Lake Lanier Living

Smart buyers employ several strategies to reduce costs while maintaining lake lifestyle benefits:

Location Optimization

- Choose lower-tax counties: Dawson County saves $4,000+ annually versus Forsyth

- Non-deep water lots: Save $50,000–$150,000 on purchase price

- Off-peak moving seasons: Negotiate better purchase prices in fall/winter

- Lake community without waterfront: Enjoy amenities at fraction of cost

Ownership Structure

- Boat club membership: $3,000–$6,000/year versus $30,000+ boat ownership

- Dock sharing arrangements: Split maintenance costs with neighbors

- Vacation rental income: Offset ownership costs when not in residence

- Primary residence designation: Lower property tax rates

Maintenance Efficiency

- Preventive dock maintenance: Avoid costly emergency repairs

- Native landscaping: Reduce water and maintenance costs

- Energy-efficient upgrades: Lower utility bills in lake homes

- Group contractor rates: Work with neighbors for bulk pricing

Working with a Lake Lanier specialist ensures buyers understand cost-optimization strategies before purchase.

Water Level Impact on Property Values and Costs

Lake Lanier water levels directly affect property values, usability, and costs:

Water Level Considerations

- Full pool (1071 feet): Optimal for property values and usability

- Conservation pool (1035 feet): Docks may not reach water

- Seasonal fluctuation: 5–15 feet typical annual variation

- Low water impact: Properties with shallow approaches face access issues

Cost Implications:

- Extended docks required for shallow coves: $10,000–$30,000

- Dredging permits and execution: $15,000–$50,000+

- Property value reduction during prolonged low water: 5–15%

Understanding Lake Lanier water levels helps buyers assess long-term property viability and avoid expensive modifications.

Buford Quality of Life: Value Beyond the Numbers

Cost of living data doesn't capture intangible benefits that justify premium prices:

Lifestyle Advantages

Recreation and Entertainment:

- 38,000 acres of Lake Lanier water access

- 692 miles of shoreline for exploration

- Marinas, restaurants, and water sports facilities

- Year-round outdoor activities

Education:

- Highly-rated Buford City Schools

- Multiple private school options

- Proximity to University of Georgia (45 minutes)

- Strong community education focus

Safety and Community:

- Below-average crime rates

- Active community organizations

- Family-friendly environment

- Strong local business support

Accessibility:

- 45 minutes to Atlanta

- 30 minutes to Hartsfield-Jackson Airport

- Major retail and entertainment nearby

- Healthcare facilities within 15 minutes

These factors contribute to property appreciation rates of 5–8% annually on Lake Lanier, offsetting higher initial costs through long-term value growth.

Frequently Asked Questions

What is the minimum income needed to afford a Lake Lanier home?

Financial advisors recommend annual household income of $150,000–$200,000 for entry-level Lake Lanier waterfront homes priced at $500,000–$800,000. This accounts for mortgage payments plus $15,000–$25,000 in annual lakefront-specific expenses including higher property taxes, insurance, dock maintenance, and HOA fees. Non-waterfront homes in lake communities require lower income thresholds of $120,000–$150,000 while still providing lake access and amenities.

How do property taxes differ across Lake Lanier counties?

Property taxes vary significantly by county. Dawson County offers the lowest rates at approximately 17 mills, resulting in $3,400 annual taxes on a $500,000 home. Forsyth County has the highest rates at 35 mills ($7,000 annually on the same home), offset by excellent schools and services. Hall County falls mid-range at 23 mills ($4,600 annually). Strategic county selection can save $2,000–$4,000 annually in property taxes while maintaining similar lake access.

Are Lake Lanier properties good investments compared to standard Buford homes?

Lake Lanier waterfront properties typically appreciate 5–8% annually, often outpacing non-waterfront Buford homes. However, higher acquisition costs ($500,000+ versus $424,000 median) and annual expenses ($15,000–$40,000 additional costs) require longer holding periods to realize superior returns. Vacation rental income potential of $35,000–$100,000 gross annually can offset costs for investment properties. Non-waterfront homes offer steadier, lower-maintenance appreciation with reduced risk.

Making Your Move to Buford or Lake Lanier

Buford's cost of living reflects its position as a premium Georgia market with exceptional lake access and quality of life. Housing costs drive the overall expense premium, particularly for waterfront properties where annual ownership costs add substantially to mortgage payments.

Buyers must carefully evaluate total cost of ownership including property taxes, insurance, maintenance, and lifestyle expenses. Strategic decisions about county location, waterfront versus lake community properties, and amenities can significantly impact affordability while maintaining desired lifestyle benefits.

Understanding these financial realities before purchase prevents surprises and ensures long-term satisfaction with one of Georgia's most desirable real estate markets. Learn more about Lake Lanier home inspection requirements to protect your investment from the start.

Ready to explore Buford and Lake Lanier properties within your budget? Schedule a personalized consultation to discuss current market conditions, inventory, and strategies for maximizing value in your purchase.

Data compiled from multiple sources including AreaVibes, PayScale, Zillow, Redfin, Apartments.com, and local Lake Lanier market analysis. Property values and costs reflect October 2025 market conditions and vary by specific location, property condition, and market timing.

About the Author: Beka Rickman

Beka Rickman is a Lake Lanier Resident and licensed Luxury REALTOR®. in Buford, GA(GA License ID 361599) who helps families navigate lakefront living with confidence. She shows properties by boat, tracks dock usability during water-level shifts, and brings insider expertise on Lake Lanier water levels, Corps of Engineers permitting, and community dynamics. With 8+ years of real estate experience and 10+ years living the lake lifestyle, she ensures clients understand not just the home—but the lifestyle that comes with it.

Contact: beka@bekasells.com • (404) 606-3905

Categories

Recent Posts