What Does It Cost to Live on Lake Lanier in 2025? | Complete Budget Guide

About the Author: Beka Rickman

Beka Rickman is a Lake Lanier financial planning specialist and real estate agent with Beka & Associates Real Estate (GA License ID 361599) who has created complete cost analyses for over 100 families considering the lake lifestyle. Beyond purchase price, she calculates the true ownership costs—including property taxes that vary by as much as $2,500 annually between counties, dock maintenance averaging $2,000–$5,000 yearly, and hidden expenses that often catch first-time lakefront buyers off-guard. As both a waterfront homeowner and rental property investor, she provides realistic budget guidance that helps clients avoid financial stress and enjoy sustainable lake living. See her budget calculator tools.

Contact: 404-606-3905 • beka@bekasells.com • Schedule your cost analysis consultation

4335 South Lee St, Suite D, Buford, GA 30518

Lake Lanier living in 2025 requires a household income of $150,000+ for median waterfront properties and annual expenses of $15,000–$40,000 beyond mortgage payments. Total costs include $500,000–$4M+ home purchases, $3,400–$11,800 property taxes (varying by county), $2,000–$5,000 homeowners insurance, dock maintenance, HOA fees, and boat-related expenses—representing 15–30% higher costs than typical Georgia averages.

Complete Housing Cost Breakdown for Lake Lanier Properties

Housing dominates the Lake Lanier cost structure, with waterfront access commanding substantial premiums over non-waterfront alternatives in surrounding communities.

Purchase Price Ranges by Property Category:

- Basic waterfront homes: $500,000–$800,000

- Updated waterfront properties with modern amenities: $800,000–$1.5 million

- Luxury waterfront estates: $1.5 million–$4 million+

- Non-waterfront lake community homes: $338,000 median

Median home values demonstrate steady appreciation patterns, with communities like Timberline at Lake Lanier averaging $455,771—up 2.0% year-over-year. The luxury segment shows particularly strong momentum, with 47% of 2025 sales exceeding $1 million (up 46% from 2023).

Rental Market Analysis:

Residents choosing rental options face $1,517 monthly averages for 1,006 square-foot apartments in the Gainesville area, while luxury lakefront rentals command $6,000–$15,000 monthly during peak summer season.

For comprehensive guidance on evaluating lake properties, review this Lake Lanier home inspection guide before making purchase decisions.

Schedule Your Lake Lanier Property Consultation

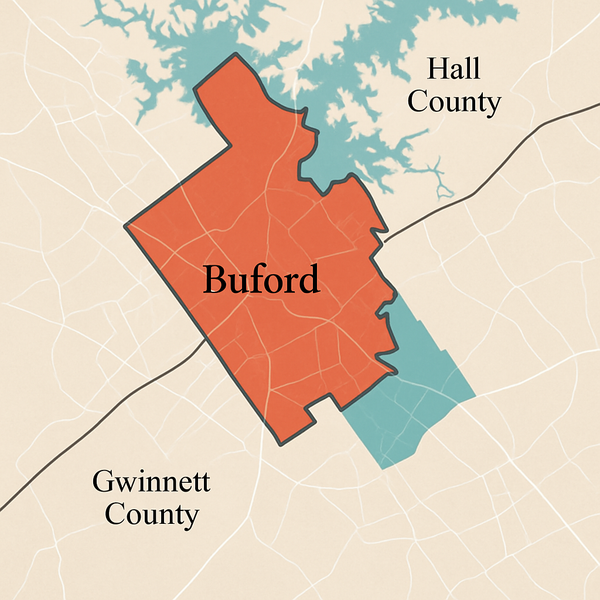

Property Tax Variations Across Five Counties: Strategic Savings Opportunities

Property taxes create one of the most significant cost differentials for Lake Lanier homeowners, with strategic county selection generating substantial long-term savings.

Effective Property Tax Rates by County:

| County | Effective Rate | Annual Tax on $500K Home | Annual Tax on $1M Home |

|---|---|---|---|

| Dawson County | 0.68% | $3,400 | $6,800 |

| Lumpkin County | 0.85% | $4,250 | $8,500 |

| Hall County | 0.85% | $4,250 | $8,500 |

| Gwinnett County | 1.0% | $5,000 | $10,000 |

| Forsyth County | 1.18% | $5,900 | $11,800 |

Long-Term Financial Impact:

A $500,000 lake home generates $2,500 annual tax differences between Dawson County (lowest) and Forsyth County (highest)—accumulating to $75,000 over 30 years. Luxury property owners face even more dramatic differentials, with $5,000+ annual variations common.

These rates reflect official county tax assessor data and state Georgia Department of Revenue guidelines. Property owners should verify current millage rates directly with their county tax office, as rates adjust annually based on local budgets and state legislation.

Detailed analysis of county-specific considerations appears in this Lake Lanier property tax comparison guide.

Annual Ownership Costs Beyond Mortgage Payments

Lake Lanier homeownership extends far beyond monthly mortgage obligations, with waterfront properties requiring specialized maintenance and regulatory compliance.

Essential Annual Expenses:

- Property taxes: $3,400–$11,800+ (county-dependent)

- Homeowners insurance: $2,000–$5,000+

- Flood insurance (often required): $500–$5,000

- Utilities: $4,000–$8,000

- HOA fees: $500–$5,000+

Waterfront-Specific Requirements:

- Dock maintenance and repairs: $2,000–$5,000 annually

- U.S. Army Corps of Engineers dock permit renewal: $835 every 5 years

- Seawall maintenance: Variable based on condition

- Boat ownership and maintenance: $3,000–$15,000+

- Marina fuel costs: $4.699/gallon (gas), $3.699/gallon (diesel)

Total Annual Ownership Budget: $15,000–$40,000+ beyond mortgage

Georgia's residential electricity averages 13.52¢/kWh (approximately 15% below national average), translating to $150–$300 monthly bills for typical properties, with larger lakefront homes often exceeding this range.

Waterfront property owners must comply with U.S. Army Corps of Engineers Lake Lanier regulations governing dock permits, shoreline modifications, and structure placement. These federal regulations supersede local ordinances and require specific permitting processes for any shoreline improvements.

Get Your Custom Lake Lanier Cost Analysis

HOA Fees and Community Amenities Investment

Many Lake Lanier communities require substantial HOA contributions that fund extensive amenities and maintenance services.

55+ Active Adult Community Annual Fees:

- Cresswind Lake Lanier: $4,644 annually ($1,161 quarterly)

- Del Webb Chateau Elan: $3,456 annually

- Village at Deaton Creek: $3,300 annually

These fees typically encompass lawn maintenance, trash service, cable television, pool access, fitness facilities, and common area upkeep. Residents receive comprehensive lifestyle amenities without individual maintenance responsibilities.

Income Requirements for Comfortable Lake Lanier Living

Financial institutions and financial planners recommend specific income thresholds for sustainable Lake Lanier homeownership.

Household Income Guidelines:

- Median waterfront properties ($570K): $150,000–$200,000+ annual household income

- Luxury properties ($1M+): $300,000–$500,000+ annual household income

- Single adult living wage (area): $23.57/hour minimum

Regional Income Context:

- Gainesville-Hall County median household income: $62,984

- Hall County median: $77,430

- Cost of living index: 6.8% lower than national average overall

According to U.S. Census Bureau data, Hall County—the primary Lake Lanier county—shows median household incomes below the recommended thresholds for comfortable waterfront homeownership, indicating that many lake homeowners draw income from Atlanta metropolitan employment or retirement assets.

The area's income requirements reflect premium lakefront positioning while maintaining more accessible costs than comparable waterfront markets nationally.

For investment-focused buyers, this Lake Lanier vacation rental investment guide provides ROI projections and income potential analysis.

Comparing Lake Lanier Costs to Metro Atlanta and Regional Markets

Lake Lanier occupies a strategic cost position relative to major metropolitan areas and rural North Georgia alternatives.

Housing Cost Comparisons:

| Market | Median Home Price | Average Monthly Rent |

|---|---|---|

| Lake Lanier | $338,000–$455,000 | $1,517 |

| Atlanta Metro | ~$400,000 | $1,500+ |

| Dahlonega | ~$300,000 | ~$1,000 |

Location Value Proposition:

Lake Lanier provides Atlanta accessibility within 45–60 minutes while maintaining lower overall living costs than metropolitan core neighborhoods. Residents gain waterfront lifestyle benefits without urban density or extreme commute requirements.

Explore Available Lake Lanier Properties

Luxury Market Segment Analysis

The Lake Lanier luxury real estate market demonstrates robust growth patterns with specific cost characteristics.

Premium properties exceeding $1 million represent 47% of 2025 sales activity, reflecting strong demand among affluent buyers seeking waterfront estates. These properties typically feature:

- Private dock facilities with multiple boat slips

- Expansive outdoor entertaining spaces

- High-end interior finishes and smart home technology

- Guest houses or separate rental income potential

Comprehensive luxury market insights appear in this Lake Lanier luxury real estate guide, including appreciation trends and premium amenity valuations.

New Construction vs Existing Home Cost Analysis

Buyers face distinct cost structures when choosing between new construction and existing inventory.

New Construction Advantages:

- Modern energy efficiency standards reducing utility costs

- Current building codes and Corps of Engineers compliance

- Warranty coverage minimizing immediate maintenance expenses

- Customization opportunities without renovation costs

Existing Home Considerations:

- Established landscaping and mature property features

- Existing dock permits avoiding new permitting processes

- Potential renovation or updating requirements

- Varying maintenance needs based on property age

Detailed comparison factors appear in this Lake Lanier new construction vs existing homes analysis.

Water Level Impact on Property Values and Costs

Lake Lanier water levels significantly influence property values, dock functionality, and overall ownership costs.

The U.S. Army Corps of Engineers manages water levels for multiple purposes including flood control, hydroelectric power generation, and recreation. Levels fluctuate seasonally and during drought periods, affecting:

- Dock accessibility and usability

- Property valuations during low-water periods

- Boat launching capabilities

- Waterfront aesthetics and beach access

Current conditions and historical patterns appear in this Lake Lanier water levels guide, providing essential context for purchase timing and property evaluation.

Schedule Your Property Showing by Boat

Healthcare and Insurance Cost Considerations

Georgia health insurance premiums for 2025 average $434 monthly for Bronze plans, representing 7.2% of household income. However, projections suggest potential increases in 2025 due to federal policy changes affecting subsidy structures.

Residents requiring flood insurance should consult FEMA's National Flood Insurance Program for current rate structures and coverage requirements. Many waterfront properties fall within flood zones requiring mandatory coverage as a mortgage condition, with premiums varying based on elevation, flood zone designation, and structure characteristics.

Healthcare access around Lake Lanier includes Northeast Georgia Medical Center facilities and numerous specialty providers serving the growing lakeside population.

Grocery and Daily Living Expenses

Monthly Budget Allocations:

- Groceries: $300–$400 monthly (Georgia annual average: $5,914, up 6.57% from 2024)

- Dining: Premium pricing at lakefront restaurants; inland options align with state averages

- Transportation: Georgia gas prices approximately $2.97/gallon

- Vehicle requirements: Personal transportation essential due to limited public transit

According to Bureau of Labor Statistics consumer price data, the South Atlantic region—including Georgia—experiences food cost inflation patterns slightly below national averages, though waterfront dining establishments command premium pricing reflecting location and amenities.

Investment Appreciation Potential and Long-Term Value

Lake Lanier properties demonstrate strong historical appreciation patterns driven by limited supply and consistent demand.

Value Growth Indicators:

- Historical appreciation: 5–8% annually for waterfront properties

- Supply constraints: U.S. Army Corps of Engineers restrictions limit new waterfront development

- Demand drivers: Atlanta metropolitan proximity, recreational amenities, lifestyle appeal

- Market resilience: Strong recovery patterns following economic downturns

The combination of limited inventory and growing regional population creates favorable long-term appreciation dynamics for strategic buyers. Federal shoreline development restrictions administered by the Army Corps of Engineers ensure finite waterfront inventory, supporting long-term value retention.

Pros and Cons Financial Summary

Understanding Lake Lanier's complete cost structure requires weighing financial advantages against premium expenses.

Financial Advantages:

- Strong property appreciation (5–8% annually)

- Vacation rental income potential offsetting ownership costs

- Lower overall costs than comparable waterfront markets

- Strategic county selection reducing property tax burden

- Atlanta accessibility without urban cost premiums

Cost Considerations:

- 15–30% premium over typical Georgia living costs

- Substantial annual maintenance requirements ($15,000–$40,000+)

- Waterfront-specific expenses (dock, boat, seawall)

- HOA fees in many communities

- Specialized insurance requirements

Complete analysis of lifestyle trade-offs appears in this pros and cons of living on Lake Lanier guide.

Get Your Personalized Lake Lanier Budget Analysis

Bottom Line: What You Need for Comfortable Lake Lanier Living

Minimum Financial Requirements:

- $150,000+ household income for median properties

- $50,000+ annual budget beyond mortgage for ownership costs

- $75,000–$150,000 down payment capability

- Emergency reserves for dock, boat, and property maintenance

Total Cost Premium:

Lake Lanier living requires 15–30% higher expenses than typical Georgia costs, driven primarily by housing premiums, waterfront maintenance obligations, and recreational expenses. However, properties demonstrate strong appreciation potential and lifestyle benefits justifying the investment for appropriate buyers.

Strategic Cost Management:

- County selection significantly impacts long-term tax obligations

- New construction may reduce immediate maintenance costs

- Vacation rental income offsets ownership expenses

- Proper insurance coverage prevents catastrophic financial exposure

Expert Lake Lanier Real Estate Guidance

Understanding Lake Lanier's complete cost structure requires specialized local expertise navigating U.S. Army Corps of Engineers regulations, county-specific requirements, and waterfront property considerations.

Beka Rickman combines 8+ years Georgia real estate experience with authentic Lake Lanier lifestyle knowledge—owning rental property, conducting property showings by boat, and maintaining weekly on-water presence. This insider perspective reveals cost factors land-based agents miss, including dock positioning, cove characteristics, and marina accessibility affecting long-term ownership expenses.

Schedule Your Lake Lanier Cost Consultation

Frequently Asked Questions About Lake Lanier Living Costs

What is the minimum income needed to afford a Lake Lanier home?

Financial planners recommend $150,000–$200,000 household income for median waterfront properties around $570,000, ensuring comfortable coverage of mortgage payments plus $15,000–$40,000 annual ownership costs including property taxes, insurance, dock maintenance, and HOA fees.

Which Lake Lanier county has the lowest property taxes?

Dawson County offers the lowest effective property tax rate at 0.68%, generating approximately $3,400 annual taxes on a $500,000 home compared to Forsyth County's 1.18% rate ($5,900 annually)—creating $2,500 annual savings or $75,000 over 30 years. Verify current rates through Georgia Department of Revenue records.

Are Lake Lanier homes a good investment in 2025?

Lake Lanier waterfront properties demonstrate 5–8% annual appreciation historically, with 2025 luxury sales up 46% from 2023. Limited supply from U.S. Army Corps of Engineers restrictions and consistent Atlanta-area demand create favorable long-term appreciation dynamics, though premium ownership costs require careful financial planning.

Ready to explore Lake Lanier real estate opportunities? Beka Rickman provides boat-based property tours revealing geographic positioning and lifestyle factors affecting long-term costs. Schedule your consultation to receive customized cost analysis for your Lake Lanier goals.

Categories

Recent Posts